It’s a tough time to be a millennial homebuyer. Despite historically low interest rates, home prices are at record highs across the country, particularly in Toronto and Vancouver. But there are ways for determined potential homeowners to find ways to get that first home.

First, the challenges. According to a recent report by BMO, 60 per cent of millennials surveyed are tired of paying rent, but 70 per cent would rather delay home ownership until they can get what they really want in a home.

But that won’t be easy. In Toronto, a detached home cost more than $968,000 in April, according to the Toronto Real Estate Board, while semi-detached homes averaged more than $679,000. And those numbers keep getting higher, with the average selling price rising 16 per cent in April compared to last year.

Semi Detachedby Brendan Lynch

Semi Detachedby Brendan Lynch

"As we move into the busiest time of the year, in terms of sales volume, strong competition between buyers will continue to push home prices higher," says Jason Mercer, the Toronto Real Estate Board’s director of market analysis. "A greater supply of listings would certainly be welcome, but we would need to see a number of consecutive months in which listings growth outpaced sales growth before market conditions become more balanced."

For a professional couple with each earning six-figure incomes, a home in Toronto is possible. But for singles, or those with children, the high numbers become an almost insurmountable challenge.

Sitting on the sidelines?

"As with many other areas of their lives, our millennial customers face unique realities in the housing market compared to past generations," said Damon Knights, BMO’s director of home financing.

Prospective home buyers should certainly not enter the market until it is personally right for them, but as they sit on the sidelines, they need to be mindful that the market is not waiting for them. If home ownership is an eventual goal, it is crucial to speak to a mortgage specialist and set up a saving strategy that responds to the ever-changing, and likely rising, rate of home prices.

And it’s not just home prices that are rising. Although today’s generation of millennials have never experienced high interest rates, basic economic theory tells us rates won’t stay low forever. And even a 1 per cent rise in interest rates could lead to a 20 per cent increase in mortgage payments, according to some experts.

The downside of waiting for the market to improve

Still, if your intention is to buy a house, there’s little sense in waiting, says Tyler Delaney, a sales representative with the Julie Kinnear Team in Toronto.

I’ve had clients who say they are going to wait and see what happens in the market, and they’ve been saying that for years. So unless you are aggressively saving at a rate that is outpacing the growth of the market, to me it doesn’t make sense to keep saving and wait for changes in the market.

Many first-time homebuyers want to avoid paying mortgage insurance premiums, calculated as a percentage of the loan and based on the size of your down payment, according to the Canada Mortgage and Housing Corporation. A down payment of 20 per cent or more means homebuyers can avoid that premium. Still, 20 per cent of a typical home in Toronto these days is between $120,000 and $150,000, Delaney notes:

That’s really tough to save. And you can gain equity in the home by putting the 5 per cent you do have down on the home.

Toronto byJohn6536

Toronto byJohn6536

So what’s the answer?

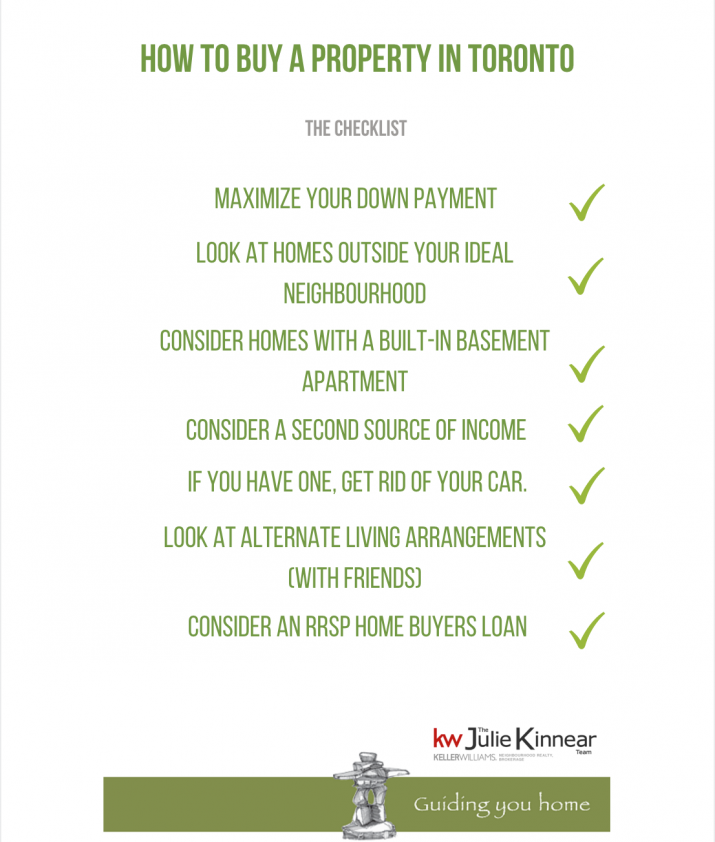

Here are some tips for young first time homebuyers:

Maximize your down payment.

This could mean borrowing from family and friends, which isn’t easy, but many parents in particular are happy to see their offspring enjoy the parents’ cash now, rather than waiting until they have passed away.

Here's a recent article we've published about parents helping their children to buy their first home, that might be useful to you.

Look at homes outside of your ideal neighbourhood.

Let’s face it, your first home won’t be your dream home. According to Delaney, you need to explore to own:

My suggestion is to remain open to explore different neighbourhoods in Toronto. Look at your first home as a stepping stone, it’s getting on the ladder; the growth will help you reach your end goal of that perfect family home.

House in Sunnylea

House in Sunnylea

Consider homes with a built-in basement apartment.

Monthly rent will help you pay off that hefty monthly mortgage payment faster and even if you are not comfortable with a permanent tenant, you can rent out your space sporadically through Airbnb, or other similar rental agencies when you are on vacation or away from your home. Delaney bought his house four years ago and felt it was a "prudent" move to rent out the basement so he could supplement his mortgage payment with that rental income:

It’s helped me pay down my mortgage faster.

Consider a second source of income.

Starting your own home-based business can bring in some much-needed additional cash, as would taking a part-time job or freelancing.

If you have one, get rid of your car.

In a big city, you can easily get around by foot, bike or public transit. And if you need a car, you can always rent one or join a car-sharing service. If your home has a driveway or parking space, you can make money by renting out the spot.

Biking in High Park

Look at alternative living arrangements.

Delaney says friends can join forces and buy a house with more than one living space:

I’ve seen a lot of people successfully purchase homes with their friends. They go to a real estate lawyer and they hash out a legal agreement to outline the details then they put their money together and find a home with two living spaces. They get on that real estate ladder and they start building equity.

Consider an RRSP Home Buyers Loan.

The Home Buyers’ Plan (HBP) allows you to withdraw $25,000 from your RRSP without paying tax immediately, as long as the funds are used to purchase a home that will become your principal place of residence.

Read more about getting the most out of your mortgage here.

Having an RRSP is great; it shows you are planning ahead. But saving for retirement can wait until you are a little older. And you need the extra cash now. You have to pay back the RRSP loan, but you have 15 years to do it. According to Delaney, there is no reason to wait to use it:

The growth in the real estate market has far outpaced investments like RRSPs so why not take money now while you still can. It’s all about choosing the best goals for you. You need a place to live and a home doubles as a strong financial investment.

Although buying a new home is a challenge for millennials in particular, it can be done. By taking some of the steps mentioned above and saving as much as you can, that first home may be closer than you think.

DW00AK