Vol. 32, Issue 1, March 2024

- Julie's Scoop

- Quote of the Day

- Krazy Kontests

- A few of our Favourite things

- Real Estate Market

- Mortgage Rates

- Feeling like Giving Back?

- The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

- Chit Chat…

- What They Got - More of our happy buyers & sellers!

Julie's Scoop

Happy Easter to all those who celebrate it!

The TOTAL solar eclipse is this Monday April 8th, coming our way. Stay safe viewing! Anyone else remember from 1979 - the last time we had a total eclipse, those big 3D rectangular boxes that had mirrors on angles to reflect the view without looking at it directly? It sounds like those are still a good option! I think it came from a cereal box or something -hahaha 😆

So much to catch up on! What an interesting first quarter we have had in real estate. I think the mild weather helped propel an early start to the market. This was welcome news. You may have seen us on Socials referencing some exciting and surprisingly strong sales by our team. Certainly starting in December, there has been more positive media coverage (mostly about potential interest rate drops), which contributed to the strong start to the year, compared to the sluggish Fall. Some buyers all of a sudden started seeing crazy stiff competition - (like competing against 20+ other offers!) in certain more affordable price ranges.

There has also been a bit of a pent up demand - ie. people decided that they were just not ready to wait forever to get on with their lives and make the move. More details in the Market Watch section. One tip is that some buyers are working with their mortgage brokers to implement a creative work around to benefit from the future expected interest rate cut, which currently is still only forecasted, and yet also to be able to buy now.

The word is now out, which means that the lack of inventory issue is resolving itself, and a more normal spring market activity is revving up, as more listings are finally available. It is becoming a bit more balanced. Good news if you’re planning a purchase.

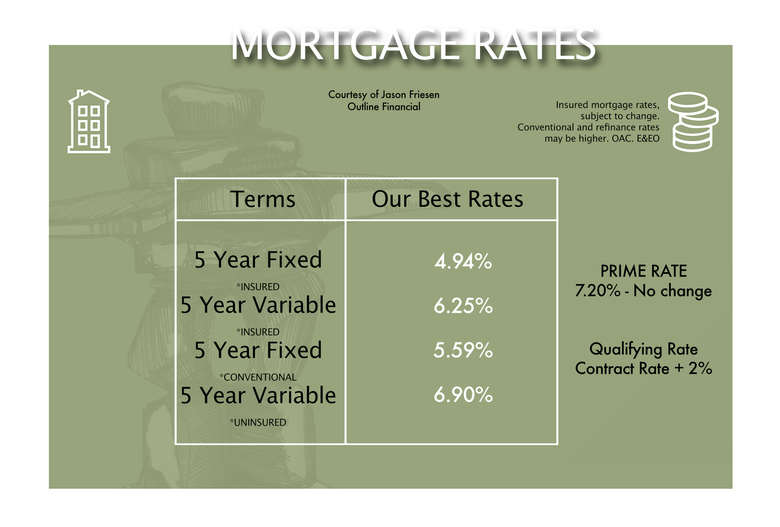

Interestingly, mortgage rates have dropped in 2024 approximately .5% so far. The mortgages that are insured, (meaning that purchase price is under $1mil, and buyers pay the insurance rates to the bank when downpayment is less than 20%). This gives more confidence to the banks that their money is safe.

Conventional mortgage rates (ie. any purchases over $1mil at a minimum).are .65% MORE than insured mortgages. All this to say, is that the purchase price under $1mil was the first to turn around and have bidding wars and generally more traction.

Stress test is currently 2% more than the rate on the contract.

Prime rate has yet to change - still at 7.20%. Variable mortgage rates have not changed significantly yet. Next rate set by Bank of Canada is on April 10, 2024.

On a more personal note, the fundraising has started for my 16th year participating in the Ride To Conquer Cancer. Here I am with the co-founder Steve Merker of the amazing event which has raised so far $280 mil benefitting the Princess Margaret Hospital. We are at a gathering for Captain’s that was held on a wet snowy day at Spin & Tonic Spin bar which got us all inspired for a great ride in June. To donate.

Julie with the co-founder Steve Merker

Georgie and Murphy enjoyed plenty of time at the cottage this winter.

Mary & I love our snowshoeing, despite a much milder winter than normal.

Lots going on personally with the team. Brenda has been cooking up a storm at home leaving Jay to enjoy as she has also been travelling out west alot. With multiple trips to Vancouver, plus Hawaii & Palm Springs, the winter flew by. Jay has enjoyed seeing live theatre and music shows, and trying out all kinds of different hipster restaurants and Toronto hotspots. Holly loved her trip to Spain!

Holly enjoying Spain

guiding you home™,

Julie

Quote of the Day:

Krazy Kontest Winners…Kongratulations!

Krazy Kontest Winner… Love supporting LOCAL! We also love the restaurants they chose!

Kongrats to December winner Deborah Gallant! Deb lives out of town, and chose Huntsville Brew House for her $75 gift card to a favourite local restaurant!

Kongrats to January winner Amy Waters! Amy chose India Alehouse on Dundas St. W.. for her $75 gift card to a favourite local restaurant!

Kongrats to February winner Tamara Bochnewicz! Tamara chose Huntsville Brew House for her $75 gift card to a favourite local restaurant!

Kongrats to March GRAND PRIZE winners - Each won a $200 gift certificate to their favourite local restaurant!

- Lina Sloan (chose Mamakas Taverna)

- Janis Stitski (chose Enoteca Sociale),

- Dave Cohen (chose Quetzal),

- Adi Pai (TBD!)

- Dale Breen (chose The Kings Kurry).

April Krazy Kontest coming soon!

The JKT - A few of our Favourite Things:

Jay

It was my first time at the Opera at Four Seasons Centre. Three hours of magic! I enjoyed this incredible production with friends of Mozart’s Don Giovanni. What a treat! Easy-peasy to get to on the TTC. Drops you off right at the Centre. I highly recommend going to FSC even if you are not a lover of opera. Can’t wait to go again later this Spring! |

|

Julie

01:05

Faraday Box for car keys

|

|

|

|

Brenda

|

Holly

|

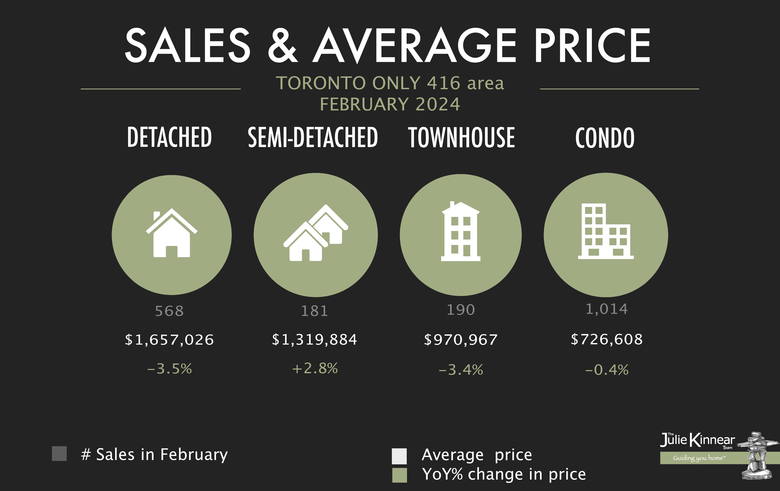

Market Watch ~ Busy Market ~ Rates expected to go down in April

GTA home sales & new listings were up on an annual and monthly basis in February 2024. Selling prices also edged upward compared to a year earlier. Population growth and a resilient regional economy continued to support the overall demand for housing. Higher borrowing costs kept home sales below the February sales record reached in 2021.

“We have recently seen a resurgence in sales activity compared to last year. The market assumption is that the Bank of Canada has finished hiking rates. Consumers are now anticipating rate cuts in the near future. A growing number of homebuyers have also come to terms with elevated mortgage rates over the past two years. To minimize higher monthly payments, some buyers have likely saved up a larger down payment, chosen to purchase a less-expensive home type and/or looked to a different location in the GTA,” said TRREB President Jennifer Pearce.

REALTORS® reported 5,607 GTA home sales through TRREB’s MLS® System in February 2024 – an increase of 17.9% compared to February 2023. Even after accounting for the leap year effect, sales were up by 12.3% year-over-year. New listings were up by an even greater annual rate than sales in February, pointing to increased choice for buyers. On a seasonally adjusted month-over-month basis, February sales were lower following two consecutive monthly increases while new listings were flat. Monthly figures can be somewhat volatile, especially when the market is approaching a transition point.

Home selling prices in February 2024 remained similar to February 2023. The MLS® Home Price Index Composite benchmark edged up by 0.4%. The average selling price of $1,108,720 increased by a modest 1.1%. On a seasonally-adjusted monthly basis, both the MLS® HPI Composite and the average selling price edged upward.

“As we move through 2024, an increasing number of buyers will re-enter the market with adjusted housing preferences to account for higher borrowing costs. In the second half of the year, lower interest rates will further boost demand for ownership housing. First-time buying activity will also be a contributing factor, as many renters look to trade high monthly rents for a long-term investment in which they can live and build equity,” said TRREB Chief Market Analyst Jason Mercer.

“Population growth has been at a record pace and with the anticipated lower borrowing costs, the demand for housing – both ownership and rental – will also increase over the next two years. Unaffordable housing not only has a financial impact but also a social impact. Recent research conducted for TRREB by CANCEA in our 2024 Market Outlook and Year in Review report underscores the negative impact of unaffordable housing on peoples’ mental health and life satisfaction. It’s comforting to see that there has been some real building happening in the GTA and that the provincial government is rewarding those municipalities that are working to eliminate the red tape and meet those homeownership needs,” said TRREB CEO John DiMichele.

Mortgage Rates

You might think that the bank you’re with is going to give you the best rate on your mortgage. Many times, you’d be incorrect.

The person you really want to speak to is a mortgage lender. All they do all day is mortgages. Many of them even have special programs that can make buying a home more affordable.

Having a pre-approval letter is essential. It also lets you know exactly how much you can afford, as online estimates are rarely accurate.

Next rate set by Bank of Canada is on April 10, 2024

Feeling like Giving Back?

This highly rated charity help at risk youth find a safe place to live, secure a job, finish high school, apply for post-secondary and trade schools, get medical attention and mental health care. Initially, their workers offer intense, one-to-one support with the youth to help stabilize their life. Once settled, a mentor volunteer can connect with the youth to establish a trusting relationship and develop life skills.

Their programs include: Homeless Prevention, and Healthy Living Programs

If you are in the position to pay it forward, please donate to a favourite charity at this time. 💕

The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

A company's success is strongly impacted by the customer reviews and for those of us in real estate, Google reviews and Facebook reviews create the biggest impact. We are asking for your help to go online and add your input and we will happily donate to a charity of your choice for your efforts!

You can do it on Google Maps here (it's very very important that youwrite a comment as well in addition to the rating), or you can also leave the same review on JKT's Facebook page here by clicking on "Yes" next to the "Do you recommend the JKT?" It's true, 5* reviews are almost as precious as a referral nowadays!

Chit Chat...

Exciting news for the Bertram family! Toronto track star Stephanie Bertram has accepted a scholarship to University of Michigan in Ann Arbor into their prestigious Track & Field / Cross Country program starting Fall 2024! #GoBlue #NewBlue

Heidi Girvan - Helping parents of children experiencing educational challenges navigate the system.

This also includes families that are new to a neighbourhood and need guidance finding the right private schools or intervention agencies.

Services include sourcing Psychologists for Psychoeducational Assessments; advocating and developing Individual Education Plans (IEP); finding the best “fit” tutors, intervention agencies and private alternative schools; helping students prepare for school interviews, etc.

What They Got - More of our happy buyers & sellers!

A continuing column of the Julie Kinnear Team's sales...

WHAT WE HAVE...

Did You Know? We have a large number of awesome trusted realtors in different towns and communities across Ontario, Canada and Internationally. Just get in touch so we can introduce you.

Our Purpose

Our purpose is for you to be so outrageously happy with the service we provide that you gladly refer us to your friends and family before you've even bought or sold with us.