Mortgage by GotCredit

For all but the luckiest among us, buying a house is the biggest investment we will ever make. Homes are where our plans see fruition, our goals are met and our families grow. So it's no wonder we agonize so much over their purchase.

Carrie Davidson

But the truth is, over the last several years, buying a home for the first time has gotten more difficult in Canada. I spoke with Carrie Davidson, AMP, Dominion Lending Centres about what’s changed.

How are things now for first-time homebuyers?

It's a very convoluted process in Canada now with all the new restrictions and rules that the government has put in place.

What sort of new restrictions?

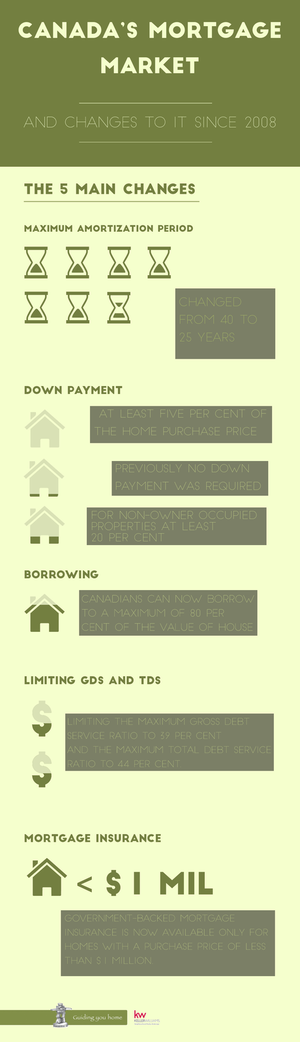

I've been doing this almost 15 years, so I used to be able to do zero per cent down, 40 year amortization — the life of the mortgage — and because of what happened stateside, the Canadian government stepped in and said 'let's put some restrictions in place as far as business for self and the maximum amortization. How much is the minimum down payment?' This changed different criteria for Canadians qualifying for a mortgage for buying their first home.

So nowadays you need at least a 20 per cent down payment, am I reading that correctly?

No. You actually need a minimum of a 5 per cent down payment to purchase a home. For anywhere between a 5 per cent to a 19.99 per cent down payment there is an insurance premium that is charged to the borrower. So that is done through one of the three insurers in Canada. CMHC is the biggest one and the one we know best because it’s government owned and operated.

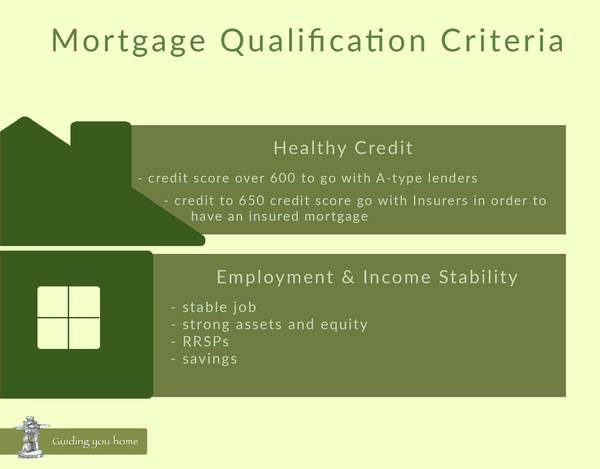

And what are the qualification criteria?

Your credit needs to be healthy, meaning your score needs to be over 600 to go with A-type lenders (the banks and A rates — the best rates I can offer through non-bank lenders as well). So a score over 600 is fine. The insurers, however, prefer over 650 in order to have an insured mortgage. Most first time homebuyers have insured mortgages because of the home prices in Toronto unless they get a hefty gift from their parents, their family, or they’re well established in their career and have been renting for quite some time and have been able to save the 20 per cent. In my experience most first time homebuyers are insured.

Another criteria is the employment and income and stability. They're not popping around to part-time jobs every three months. That's also criteria that lenders and the insurers look at. They look at the assets and equity—the strength of the file through assets and equity that the borrowers have in place. They evaluate if they have RRSPs, they have some savings, they have some established equity in their various accounts. So for insured mortgages with less than a 20 per cent down payment, a premium will apply. So that's between 5 per cent and 19.99 per cent. In the GTA it's fairly well known that an unofficial requirement is that the deposit with your offer is 5 per cent of the purchase price and that is part of your down payment. In some cases it’s the only down payment if the clients only choose to put 5 per cent down, but it’s something that they need to have readily available when they make an offer with a realtor.

In the GTA it's fairly well known that an unofficial requirement is that the deposit with your offer is 5 per cent of the purchase price and that is part of your down payment.

There is so much to know about mortgages before getting one, and it's really confusing if you don't have someone to explain it to you.

I often say to people, speaking mortgages is like speaking Greek when you don’t speak Greek. I don’t want to intimidate clients, but there are things that they do need to know before they make an offer to purchase a home.

And what about the break on RRSPs?

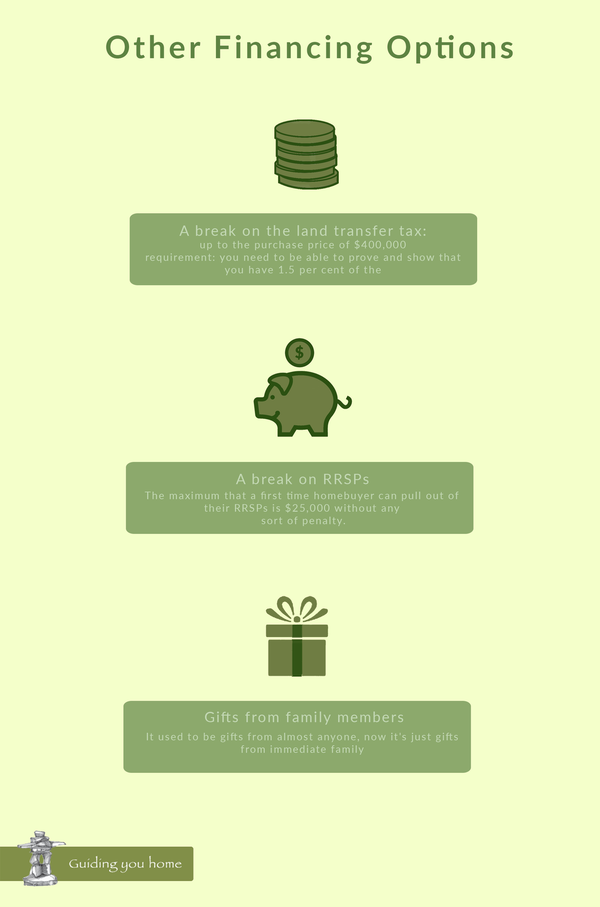

The maximum that a first time homebuyer can pull out of their RRSPs is $25,000 without any sort of penalty.

And that's specifically if you're using it to buy a home?

Yes. I mean, it goes toward the home purchase. It doesn't necessarily need to go toward the down payment. It could be for renovations or for buying furniture. It's the only time you can redeem without penalty. It doesn't necessarily need to be toward the purchase. I would say 95 per cent of the time my clients are using it toward their down payment, but it can be used for other reasons if they have other savings for the down payment that they've committed to. It's the only time that they can redeem it. There are some criteria around not owning a home for seven years. It gets kind of complicated on the government website as to what qualifies as a first time homebuyer. So if somebody buys a home and then sells it and doesn't own it and is not on the title of any property for seven years they can reapply as a first time homebuyer and use their RRSP.

I would say 95 per cent of the time my clients are using their RRSPs money toward their down payment.

Are there other options for first time homebuyers to get financing?

There is a break on the land transfer tax for first time homebuyers. Up to the purchase price of $400,000 there is a waiver of the Toronto land transfer tax. So if somebody is buying a condominium, and it usually is for that price point in Toronto, they don’t have to pay the land transfer tax for the city of Toronto and they do get a break as well on the municipal land transfer tax.

Especially younger people who are scraping, scraping, scraping, saving, saving, saving their 5 per cent down. They also need to be able to prove and show that they have 1.5 per cent of the purchase price. So using a $400,000 condo as an example, they must have $6,000 for the land transfer tax charge, which is due at possession date, closing date, when they take possession of their new home at the lawyer’s office. And of course there's the lawyer's fees which can vary from $1,000 to $1,500 depending on the lawyer.

It isn’t necessarily easy or cheap breaking into the housing market for the first time.

There aren't too many breaks. I mean, you can draw on your RRSP and you do get a break on the land transfer tax. It's tough to get your foot in the door as a first time homebuyer with the increasing prices.

What about gifts from family members?

Lenders have pulled back a little bit on this insofar as it used to be gifts from pretty much anyone, but now it's gifts from immediate family (so people like grandparents, parents, children) —so it's really quite limited to blood.

So your aunt can't lend you money?

I've worked around that (laughs), as long as it is a relative. It just can't be 'your friend Steve', because then you get into legal situations where it's like 'well I lent you $30,000 toward your house and now you're being a jerk and I want the money back' and then you get into all sorts of legal proceedings around that. It's something that the banks and lenders have kind of tightened up again due to the government rules that have been implemented because there's enough infighting among families, let alone friends. So it's okay if there is a gift letter that is signed saying it's a non repayable gift so that it's held as a contract, if you will, with the lender.

It just can't be your friend Steve, because then you get into legal situations where it's like 'well I lent you $30,000 toward your house and now you're being a jerk and I want the money back' and then you get into all sorts of legal proceedings around that.

That counts toward your total amount of money going towards the house?

Yep. For down payment and for closing costs. If there is a $10,000 deposit in one of the statements a client provides me I need some sort of documentation to back that up—where did that come from? So there are questions and red flags around fraud, like where is that money coming from, is it money laundering? The lenders and banks, the financial institutions in Canada, need to do their due diligence extra carefully now to check if there is a larger amount that's not a regular pay from your payroll going in and where that money came from. So I would need a gift letter showing that $10,000 from mom and dad is a non repayable gift towards the purchase of such and such a property.

Before the housing crash in the States anybody could have lent you money?

Yeah, pretty much. I mean, people were borrowing from their personal lines of credit which in essence adds to their liabilities. It's not equities, whereas now they're tightening up so the down payments and closing costs can only come from savings-slash-equity, not from borrowing from your credit cards or borrowing from your personal lines of credit which adds more to the liability. So it's very clear that it's from your own assets or from a gift from family.

Recent changes in mortgages

So it's fairly recently these rules have changed?

Yes, and they've been gradual. They haven't implemented 15 rules in one day. But they've kind of done a couple one year and then maybe four the next year. I would say it's all together over the last seven years or eight years. Since 2008.

Have all these changes made your job harder?

It has. And for people who have bought their first home 12 years ago and now they're buying their second home where the rules have changed so much. I need to re-explain 'this is how it works today, not 12 years ago when you bought your first home'.

It's a whole new ball game.

It is. And it gets very complicated when it’s a self-employed situation with somebody who has a lot of write-offs. So they may make $100,000 but to Canada Revenue Agency they may claim $20,000 because they’ve used $80,000 as a write-off. So we used to be able to do Stated Income Programs, where as they’re making a hundred grand a year, but they're only claiming $20,000. My views—and others—on this is that the government is really trying to have people claim more so that they can collect more.

That's interesting.

If you want to buy a home, you need to be making $70,000 to qualify for the mortgage that you're looking for but you're writing off so much like your dog food or your vet bills or your haircuts towards your business and really those kind of things wouldn't be legitimate. It's really encouraging people to claim more on their taxes so that they can use their line 150 from their notice of assessment to qualify for a home purchase, not just use a stated income program where you can say you make $120,000. You've got to prove you're making what you say you're making to qualify for this mortgage. So, for business and for self, we're using the two most recent years' notice of assessment.

You've got to prove you're making what you say you're making to qualify for the mortgage.

What’s the line 150?

The line 150 is the income amount you make after your business deductions. It can be very different from what your actual gross income is, especially if you’re a gardener or a painter. There are definitely legitimate business expenses. It's when people get paid cash for something and they're not claiming it because they don't need to. So they're claiming $20,000 instead of the $80,000 they actually make because so much of their business is a cash business—a taxi driver, that type of thing. We now need to use the true and actual number on line 150 to qualify and carry the debt that they're going into with a mortgage as a homeowner. It is very complicated.

I can see how this would be fairly daunting for first time homebuyers.

Absolutely. It is very daunting, however so much of my business is to educate the clients, the buyers, on this information so that when they make an offer, when I say 'yes, you can afford this, yes this will go through, you will get your keys on your possession date' they will get their keys on the possession date. It is very daunting and I don't want people to be over extended—to buy something and not be able to live their life, or to go into arrears on their mortgage payment. That's something I'm proud to say has never happened with my clients because I'm very careful with them about what their comfort level is for their mortgage payments. Going from $1,000 rent to $2,200 mortgage payments on a home where you're still responsible for paying your own property tax or replacing the roof plus the other expenses of a homeowner, not just a renter is a big change. So it's something I talk about with upfront with clients to make sure that they feel comfortable moving forward with the payments they know they would make on the mortgage alone.

Is it house poor when you spend all your money on a house and can't really do much?

Absolutely. I say to people 'I want you to be able to go on the odd vacation or to go out for dinner every one in a while' and you have other financial goals as well so yes, your home is a huge investment. Especially with how the prices keep increasing, increasing, increasing and it's amazing to me. I'm going through it now with a client who bought for $601,000 five years ago in High Park and now her house is worth $850,000. That's a huge investment when you buy a house and you're freaking out because it's $601,000 but five years later you've made so much return on your investment.

Especially in Toronto these days...

That's just it. People get very nervous, especially now. I mean, I have first time homebuyers buying at $900,000 or a million dollars and they're kind of freaking out. But Toronto homes seem to be holding their value very well.

Let's get back to mortgage basics 101. Can you explain the amortization period to our readers?

That's a restriction that the government put in place over the last three years. The maximum amortization (that's the life of the mortgage) for an insured mortgage with a less than 20 per cent down payment is 25 years. So, the longer the amortization the more you can afford because you're spreading the life of the mortgage higher, for a longer period.

The maximum amortization (that's the life of the mortgage) for an insured mortgage with a less than 20 per cent down payment is 25 years.

So an amortization is basically saying 'you're going to pay this off in 25 years or 30 years...'

Right. It's the life of the mortgage. As I said earlier, I used to be doing 40 year amortizations. Well, with 5 per cent down or no money down, even though the interest accumulated over that period of time would be much higher because the life of the mortgage is extended to that 40 years. Now, with less than 20 per cent downpayment—an insured mortgage—the government has said the maximum we can go to with amortization is 25 years. So the clients need to be making really decent income in order to qualify for a mortgage even with 5 per cent downpayment because the life is tightened up to 25 years. If you have 20 per cent or more we are allowed to extend it as far as the maximum of 30 years now. It makes it more difficult for first time homebuyers because you're qualifying on a shorter period of time at 25 years so there isn’t that extra 15 years to be able to qualify on a longer period of time. So by shortening it to 25 years, it restricts the first time homebuyer that may have likely less than 20 per cent down payment to qualify for a mortgage.

That was a government rule that was put into place about three years ago and it's really tough to qualify clients who are first starting out.

They're first time homebuyers, they're just out of university, they're just starting as managers of companies, or accountants or lawyers and their income isn't as high as it will be in 10 years. It's really tough to qualify on a shorter period of time of 25 year amortization.

And you can't look at projected salary growth over the next five years or something?

Absolutely you cannot. It has to be today's salary. If you're on a salary where you get paid every second Friday or every second Thursday and your taxes are taken off by your employer, it's what your gross income is in a year; what you're currently making now, today. It's not 'but I’m getting a raise in March 2016.' Well, if you’re buying a house now we're using that $50,000, not the $75,000 it's going to be increased to. We have to use today's figures.

HOMEBUYERS NEEDS TO BE CREATIVE

Holly Chandler

Still, there are a few options and breaks if you're a first time homebuyer. Many people are having their more financially solvent parents co-sign their mortgages says Holly Chandler, sales representatives with the Julie Kinnear Team at Keller Williams.

"Quite often, for one thing, parents—especially boomers— have been getting involved with funding their children's home purchase. They'll give a large sum of money. I've seen some that will give them $1,000,000 or $700,000. It's an astonishing amount of money sometimes,"

says Chandler.

Co-signing is when you have a parent, or somebody else, who will need to be on the mortgage as well. Maybe their income is higher or more stable, or they have greater assets so they’re seen by the lender as being more stable so that allows their kids to get a mortgage.

With home prices appearing to have no limit in Toronto, it might seem impossible to break into the market here, but Chandler believes there are other options. One growing trend that she has noticed is first time buyers purchasing a home together and splitting it up.

I'm seeing a lot of buyers buy properties together—younger people who are buying houses that they can divide into two. Otherwise they wouldn't be able to afford it,

says Chandler.

Chandler says that to purchase a property in Toronto, buyers might just need to get a little more creative.

"There are other ways of getting into the market, like the co-owning and buying with friends,"

she says.

Not everyone of course can get parental cooperation or money from them, so there are also areas that are not gentrified. There have been so many areas over the years where people were like 'oh my god, I wouldn't want to live there' and now those are the hotspots and that happens over and over again.

All the information: the numbers and the percentages of numbers, the taxes, the documents; it can all be very intimidating for first time homebuyers. Speaking with an informed mortgage broker is a good first step.

No matter what the price or which market you’re looking in, buying your first home is scary. Indeed, it might be one of the most intimidating ventures you’ll ever undertake. Being prepared and aware of your options is the best tactic against being overwhelmed. And while new regulations over the last few years have made it more difficult to break into the market, there are still some breaks for first-time buyers. Speak with a mortgage professional as well as your realtor so that you understand all the information and so you can make the best possible choice for your future.

Your opinions:

@juliekinnear @jimyih If you aren't careful, you can blow your hard won mortgage rate shopping savings on overpriced lender life insurance.

— Jim Ruta (@JimRuta) December 3, 2015

@juliekinnear @sherazali @joesammutmtg excellent guide for #firsttimehomebuyers ! how about some information on purchase plus improvements?

— Joe Sammut (@joesammutmtg) December 1, 2015

RT @juliekinnear: The must read for home buyers #mortgage https://t.co/dgsXzJrfaL @DonMillerGroup @UAMC_LLC

— Don Miller Realtor (@DonMillerGroup) December 1, 2015

@juliekinnear @TdotProperties @kwtara my best advice is always to not rush in and review your cash flow. Better off to start small and have$

— Tara Watson (@kwtara) November 30, 2015

@juliekinnear @investdrei @ChrisHLeader Don't forget about the municipal land transfer tax. It could be a big factor for first time buyers!

— richardsilver (@richardsilver) December 2, 2015

TT00EV