Home sales and the average selling price in the Greater Toronto Area (GTA) in June 2023 remained above last year’s levels. Seasonally adjusted sales dipped on a month-over-month basis. The seasonally adjusted average selling price and the MLS® Home Price Index (HPI) Composite benchmark were up compared to the previous month.

“The demand for ownership housing is stronger than last year, despite higher borrowing costs. With this said, home sales were hampered last month by uncertainty surrounding the Bank of Canada’s outlook on inflation and interest rates. Furthermore, a persistent lack of inventory likely sidelined some willing buyers because they couldn't find a home meeting their needs. Simply put, you can't buy what is not available,”

said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

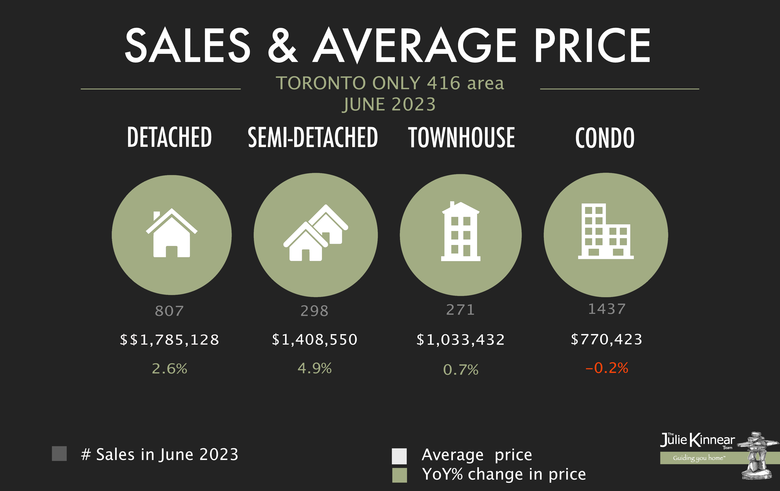

GTA REALTORS® reported 7,481 sales through TRREB’s MLS® System in June 2023 – up 16.5 per cent compared to June 2022. The number of listings was down by three per cent over the same period.

The year-over-year increase in sales coupled with the decrease in new listings mean market conditions were tighter this past June relative to the same period last year. The average selling price was up by 3.2 per cent to $1,182,120. The MLS® HPI Composite benchmark was still down by 1.9 per cent on a year-over-year basis - the lowest annual rate of decline in 2023. On a month-over-month basis the seasonally adjusted average price and MLS® HPI Composite benchmark were up.

“A resilient economy, tight labour market and record population growth kept home sales well above last year’s lows. Looking forward, the Bank of Canada’s interest rate decision this month and its guidance on inflation and borrowing costs for the remainder of 2023 will help us understand how much sales and price will recover beyond current levels,”

said TRREB Chief Market Analyst Jason Mercer.

“GTA municipalities continue to lag in bringing new housing online at a pace sufficient to make up for the current deficit and keep up with record population growth. Leaders at all levels of government, including the new mayor-elect of Toronto, have committed to rectifying the housing supply crisis. We need to see these commitments coming to fruition immediately, or we will continue to fall further behind each month,”

stressed TRREB CEO John DiMichele.

“In addition to the impact of the listing shortage, housing affordability is also hampered on an ongoing basis by taxation and fees associated with home sales and construction as well as the general level of taxation impacting households today. Going forward, we need to look at all of the factors influencing the household balance sheet and people’s ability to house themselves,”

continued DiMichele.