Construction in Toronto

by JasonParis

This September was quite cold for the real estate market. After the introduction of new measures aimed at cooling the market, sales really slowed down. According to the Toronto Real Estate Board, sales of detached houses were 19 per cent down in the GTA, and in the City of Toronto itself, they were decreased 27 per cent. This is probably what Jim Flaherty wanted.

Cold September

Although all economic indicators were improving, the rising GDP (1.8%), growth of employment in Toronto (1.6%), and decreased inflation (-1.2%) didn't translate into higher house sales. Therefore it seems that after the economically cold summer, a chilly autumn will come. In comparison to September 2011, the number of transactions was down by 21 per cent. Analysts at TREB claim that the lower number of working days in September have to be taken into account, but others like David Madani, who works for Capital Economics, say that this is just an attempt add some colour to an otherwise bleak picture.

On the other hand, prices that buyers pay for their houses and condos continue to rise. The prices in Toronto's real estate market increased more than 8.5 per cent compared to last year. The report by Greater Toronto Area realtors says that of the 5,879 homes sold by the firm in September, the average selling price was $503,662. If we exclude condos and semi-detached houses, the price will be even higher. Detached houses were sold on average in September for $800,000. Buyers have to pay 5 per cent more for condos and on average more than 16 per cent if all types of housing are included.

In the City of Toronto, 2,255 houses were sold with an average price of $547,901. The median price was a bit lower, at $430,000. The selling price was in average 99 per cent of listing price, which is slightly higher than in the rest of the GTA. Properties in Toronto are usually sold within one month after being listed.

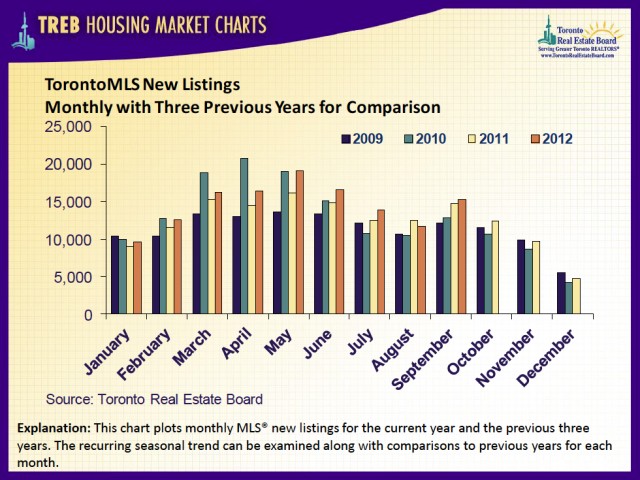

TorontoMLS New Listings by TREB

Economic Theory Doesn' Work

But how is that possible? Economic theory says that with faltering demand, prices should decrease — the exact opposite of what is happening now. The answer can be found when we look at different categories of real estate. As was said before, the present situation on the market is the result of the new rules. A decrease of the maximum length of amortization and tighter lending requirements simply do not have the same impact on all buyers. More affluent purchasers weren't hit that hard by these rules. Therefore, although demand is lower in general, the remaining buyers are buying more expensive properties.

Moreover, because now many potential buyers can't afford new, bigger houses and condos, they are postponing their purchases. Since older properties make up a significant part of the market, this not just influences lower demand but also decreases offers because the chain of residents constantly moving up to properties of a higher standard is now broken. With falling sales, developers are rethinking their strategies and are postponing new projects. Currently there are 420 active sites around the GTA. Barry Lion, market analyst, claims that developers will decrease this number to less than 350. This will just further increase the influence of older condos and houses on price levels.

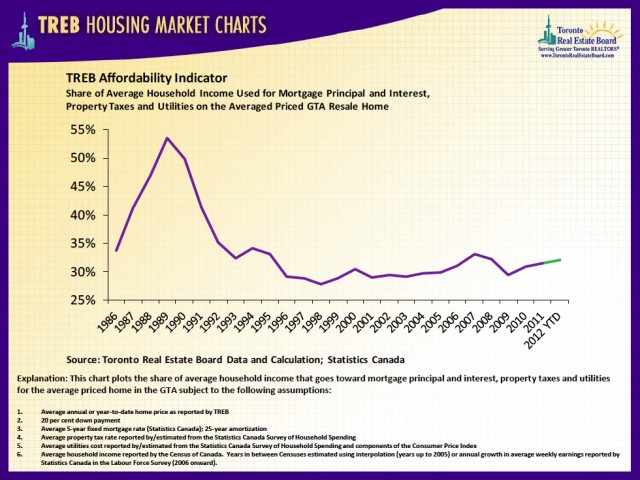

TREB Affordability Indicator

Future Developments

Since there isn't any economic turmoil on the horizon, the new lending rules won't be reviewed in the coming months, but we can expect some changes on the market. Firstly, developers will probably try to offer cheaper housing projects to stimulate demand. However, their planning and development will take some time and therefore this trend of faltering demand but rising average prices is likely to continue throughout 2013.