The Toronto Regional Real Estate Board (TRREB) has released its eagerly awaited 2026 Market Outlook and Year in Review report. This comprehensive analysis describes a Greater Toronto Area (GTA) housing market characterized by greater options for buyers and enhanced affordability, tempered by ongoing caution among consumers.

Key findings indicate that high inventory levels should continue to moderate price increases throughout 2026. Overall home sales are projected to stay roughly in line with the volumes seen over the past three years, though there is upside potential in the latter part of the year fi the economy holds steady and buyer confidence rebounds.

The report features fresh data from an Ipsos survey on consumer attitudes, details on prospective homebuyers' plans, TRREB's projections for sales and average prices, and ni- depth research into regional housing supply, immigration patterns, and affordability challenges.

Outlook for 2026 TRREB anticipates:

- GTA home sales totaling 60,000 to 70,000 units. Activity in the first half of the year is likely to mirror 2025 patterns, with many households hesitant to lock into extended mortgage commitments amid economic uncertainty. Should conditions improve later in the year-including stronger confidence-accumulated demand from recent years could start to drive more activity.

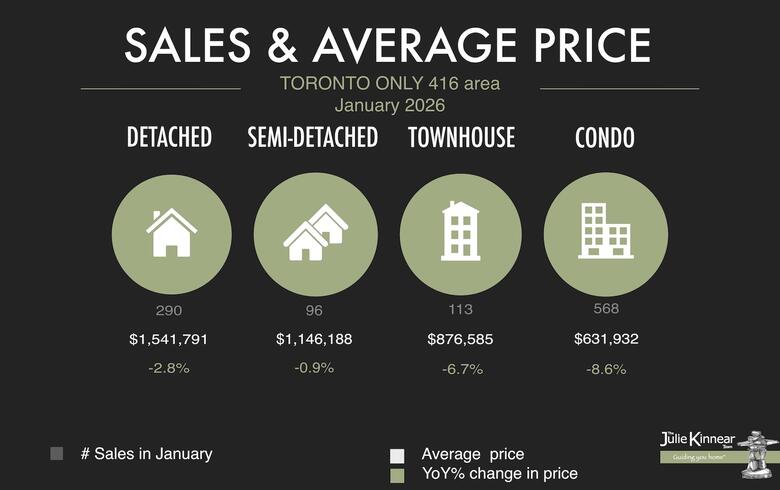

- Average GTA home prices ranging from $1 million to $1.03 million. Abundant supply in various segments, especially condominiums, will give buyers considerable leverage in negotiations. Prices may dip year-over-year during the early months before leveling off in the second half, assuming more buyers re-enter the market and conditions become more balanced.

The Ipsos survey revealed that only 22% of GTA households intend to purchase a home in 2026, a drop of five percentage points from the prior year, even with affordability gains. This reflects persistent concerns about economic stability.

That said, first-time buyers could play a pivotal role in any upturn, as 45% of those planning to buy in 2026 are entering the market for the first time-highlighting the need for accessible entry-level options.