Vol. 30, Issue 4, December 2022

- Julie's Scoop

- Quote of the Day

- Chit Chat...

- JKT is GROWING! Spotlight on Nelson Coelho

- Krazy Kontests

- Real Estate Market

- Mortgage Rates

- Feeling like Giving Back?

- The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

- What They Got - More of our happy buyers & sellers!

- A few of our Favourite things

Julie's Scoop

Happy December! Hope you’re enjoying the relatively mild weather and excitement leading up to the Holidays.

The JKT is doing well - we are thrilled about volunteering for the first time in person since 2019 at Daily Bread Food Bank. We had lots of excited compliments on the Movie Matinee client event - one of our few in person events since Covid - watching flicks on the big screen is still such a thrill.

The FIFA World Cup has been so captivating. Talking about sports…Have to add that I am of course pretty over the moon with the Leafs these days and watching Marner make history with his 22 games and counting with a point or more :)

The JKT continues to Grow! Check out the article - Spotlight on Nelson Coelho. You may have already had the pleasure of dealing with him as he is our amazing Client Care & Operations Specialist.

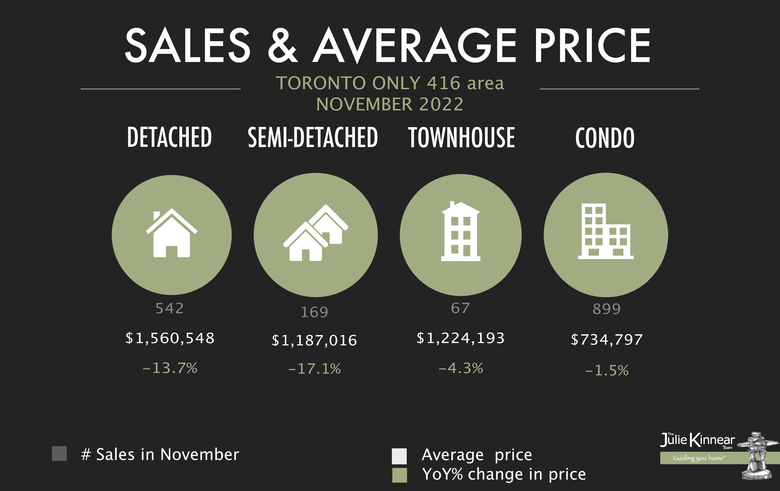

TRREB has come out with their November Market Watch report. I have put together a video explaining a few of the current numbers and what our team is experiencing in the real world market - not just stats. Below are some of the numbers specifically Toronto based. Keep in mind it is focusing on one month - and can be a bit dramatic when looking at just one month vs whole year. Detached and Semi are down more than attached/townhouses and condos. As the stats are for the whole city of Toronto, contact us for specific information about your neighbourhood or property. Currently the real estate market is moving, albeit not at the frenetic pace as during the massive run ups in prices, but clients are moving on with their lives, and it is more of a balanced market. There are opportunities for sellers and for buyers.

Affordability for buyers goes down as the interest rates go up. So buyers have to remember that their buying power is better now than it could be in the future. And on the flip side, buyers can afford more now while they are locked into lower rates. Good news is that in Canada, GDP growth in the third quarter was stronger than expected. Canada’s labour market remains tight, with unemployment near historic lows.

A few big changes are coming to Toronto HOMEOWNERS - including Toronto’s new Vacant Home Tax. I first heard about this in Vancouver, and now it is coming here. You may have received your notice.

The goal of the City of Toronto’s Vacant Home Tax (VHT) is to increase the supply of housing by discouraging owners from leaving their residential properties unoccupied. Homeowners who choose to keep their properties vacant will be subject to this tax. Revenues collected from the Vacant Home Tax will be allocated towards affordable housing initiatives. Principal residences may be left unoccupied for periods of up to a total of six months throughout the taxation year without being subject to the tax.

Another new Federal Government initiative comes into effect Jan 1/2023. There is a two-year ban on foreign corporations and individuals who are not citizens or permanent residents of Canada from buying certain categories of real property. This includes direct and indirect purchases. The ban is aimed at buyers who have no connection to Canada. Buildings with more than three units are not covered by the ban among other conditions. The Ontario government recently raised the province’s foreign buyers’ tax to 25 per cent from 20 per cent.

Happy Holidays!

guiding you home™,

Julie

P.S. Stay safe. We are ALL in this together!

Quote of the Day:

Chit Chat...

Alison Lacy has jumped right into her artistic passion project of A Flair For Chairs you can find a few of her finished projects on Insta. Give her a follow!

Alison is a designer of upcycled antique chairs and creating fabulous fashion forward chairs! Who knew that an old antique could have this incredible resurgence! Environmentally friendly too :)

Kristi Herold launched her first book this past month - and it’s a winner! Superb for business owners, and leaders in all kinds of capacities. Lesson #1 is the title of this fun and inspiring book - It Pays to PLAY: How Play Improves Business Culture.

Talk about a refreshing and energizing way to increase work team happiness and long term success. Innovative ideas. Kristi is an old friend/client and colleague from our College Pro Painters days. I have watched her in awe since we met as she continually conquers challenges, rises to the top of her profession, as well as any adventures along the way. Congratulations Kristi!

JKT is GROWING! Spotlight on Nelson Coelho

Getting to know Nelson…

Nelson comes to us with a wealth of business knowledge in the corporate world! He made his transition into the Real Estate business in March of 2021. He is our Client Care and Operations Specialist as well as a licensed Realtor. Nelson’s passion for people was a big part of that decision, his mission is to make sure all his clients, co-workers, friends and family are well taken care of.

Nelson enjoys spending time with his fur baby, Chloe, and plays volleyball Tuesday nights as a member of the Toronto Spartan Volleyball League (TSVL) in Toronto. He spends a lot of time with his family when he is not working and planning the next vacation.

More FUN FACTS:

Do you have any siblings? Yes, I’m one of five siblings in my family, 4 sisters. That extends to 4 brother in laws and 9 nieces and nephews. Holidays are always an amazing time!

How are your cooking skills? They are ok. Not a fancy chef but can definitely feed myself and my guests that come over. Luckily, my partner enjoys cooking so that has been taken care of!

What is your favourite junk food? CHIPS!!!

Favourite place to travel? The motherland, Sao Miguel, Portugal. It’s a great feeling to be in the middle of the Atlantic with consistent comfortable weather all year around!

Click here For Nelson’s in depth profile online.

Krazy Kontest Winners…Kongratulations!

We are continuing the theme for prizes of $75 GC to the restaurant of your choice and supporting local businesses!. BTW you can enter this month's Krazy Kontest HERE.

November Winner is Judy Green! Judy chose a $75 GC to The Ace restaurant on Roncesvalles Ave!

Market Watch ~ What is changing for homeowners - See Below for CITY OF TORONTO results.

Watch Julie's analysis:

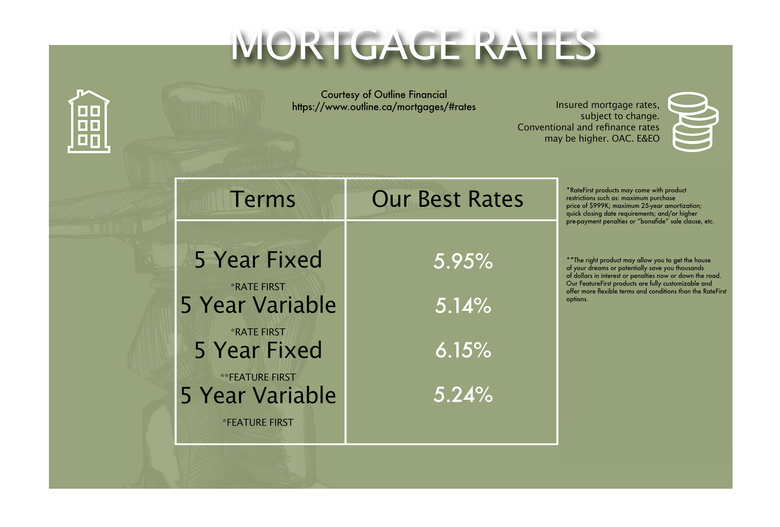

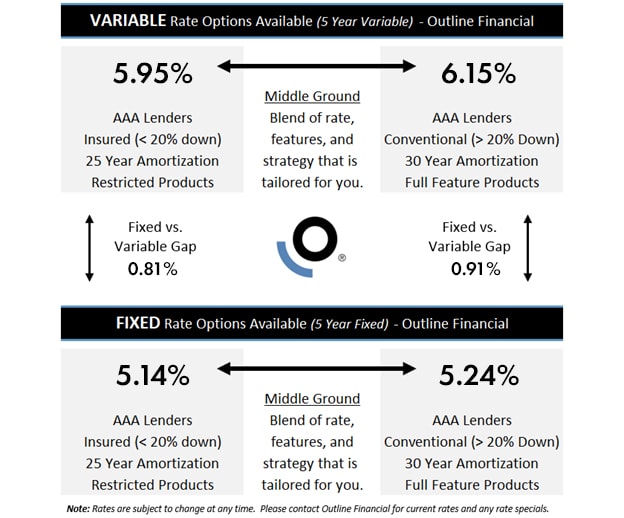

Mortgage Rates

On December 7th, the Bank of Canada (BoC) increased its overnight rate by 0.50% (50 basis points “bps”), lifting it to 4.25%. Lenders followed by raising their Prime lending rates from 5.95% to 6.45%. This increase was on the higher end of economists’ expectations which was evenly split between a 25 and 50 bp increase. This is the BoC’s seventh consecutive rate hike in a row and caps off an unprecedented year for the Bank.

While we don’t anticipate the BoC will start reducing rates until late 2023 or 2024, most economists believe we are within 25 bps from the peak and we could see the BoC pause as early as their next meeting on January 25th, 2023.

Variable Rate forecast - as variable rates are linked to a lenders'/banks' prime lending rate, any interest rate movement by the Bank of Canada (BoC) typically results in an immediate change to variable rates. A summary of the 2022 BoC meeting dates & actual changes, and our expectations are as follows:

Jan 26, 2022 (actual: no increase)

Mar 2, 2022 (actual: +0.25% increase)

Apr 13, 2022 (actual: +0.50% increase)

Jun 1, 2022 (actual: +0.50% increase)

Jul 13, 2022 (actual: +1.00% increase)

Sep 7, 2022 (actual: +0.75% increase)

Oct 26, 2022 (actual: +0.50% increase)

Dec 7, 2022 (actual: +0.50% increase)

As at the time of writing, the Big 6 Banks are generally forecasting the BoC to remain relatively flat during 2023, and then decline back to the 3.0% range by the end of 2024. As we are in unprecedented times (the BoC has never raised rates so quickly), we will continue to monitor the forecasts and impact closely and update the information when applicable.

Fixed Rate Forecast - 5-year fixed rates typically follow the Government of Canada's 5-year Bond Yields which is the market's view/prediction of where interest rates will be in the future.

5-year bond yields began their ascent in late 2021 and early 2022 in anticipation of the Bank of Canada rate increases that started in March 2022. Yields moved from the 1.5% range in January 2022 to a peak of 3.8% in October with 5-year fixed rates increasing accordingly. That being said, 5 year Canadian bond yields dropped on November 10th when US inflation figures came in below expectations (signaling that the economy is responding to Fed/Central bank rate hikes). Bond yields are now in the 3.30% range, and if they hold, we could see lenders/banks lower their 5 year fixed rates in the coming weeks.

Timely and Shareable News Articles:

- Canada's inflation surge stalls at 6.9%: What you need to know (Financial Post)

- What is the Bank of Canada Interest Rate (Financial Post)

- Are Canadians worse off financially now than in the 1980's? (Globe & Mail)

- BoC's Macklem says interest rate hikes are nearing an end, but to expect borrowing costs to rise before levelling out (Globe & Mail)

Feeling like Giving Back?

As we are fast approaching the holidays, there are still too many families that struggle to put food on their table and provide their loved ones with a festive holiday. It’s organizations like the Daily Bread Food Bank that make it possible!

We will be volunteering at the Daily Bread Food Bank on Dec. 14th, this is something we enjoy every year to support our communities we live in. Please click on the name above to visit their website and make a donation.

Volunteering at the Daily Bread Food Bank

We support their vision to “End Hunger in our City” and mission “We collaborate with all to eliminate food insecurity, and advocate for solutions to end poverty”.

If you are in the position to pay it forward, please donate to one of these worthy charities during this time. 💕

The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

A company's success is strongly impacted by the customer reviews and for those of us in real estate, Google reviews and Facebook reviews create the biggest impact. We are asking for your help to go online and add your input and we will happily donate to a charity of your choice for your efforts!

You can do it on Google Maps here (it's very very important that you write a comment as well in addition to the rating), or you can also leave the same review on JKT's Facebook page here by clicking on "Yes" next to the "Do you recommend the JKT?" It's true, 5* reviews are almost as precious as a referral nowadays!

Interested in new build condos and townhouses? We have access to pre-public sales of new developments. Be sure to get in touch to take advantage of this leg up!

What They Got - More of our happy buyers & sellers!

A continuing column of the Julie Kinnear Team's sales...

|

|

|

|

25 Ritchie Ave, #309 - Parkdale - represented seller |

140 Simcoe St, #502 - Downtown Toronto - represented seller |

|

|

|

|

45 Garden Ave - Parkdale - represented seller |

|

|

|

|

Did You Know? We have a large number of awesome trusted realtors in different towns and communities across Ontario, Canada and Internationally. Just get in touch so we can introduce you.

Our Purpose

Our purpose is for you to be so outrageously happy with the service we provide that you gladly refer us to your friends and family before you've even bought or sold with us.

The JKT - A few of our Favourite Things:

Holly

|

|

Jay

|

|

Julie

|

|

Brenda

|

|

|

|

|

Emily

|

|

Nelson

|