Vol. 31, Issue 1, January 2023

- Julie's Scoop

- Quote of the Day

- Chit Chat...

- Krazy Kontests

- A few of our Favourite things

- Real Estate Market

- Mortgage Rates

- Feeling like Giving Back?

- The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

- What They Got - More of our happy buyers & sellers!

Julie's Scoop

Happy New Year! I hope you had a wonderful and restful holiday season. Wishing you much joy, peace and good health in the year ahead.

The holidays are always a highlight for me and the team. This year weather wise it was pretty crazy with the massive snow storm in Ontario. Unfortunately it changed a lot of people’s plans and many family get-togethers had to be cancelled or postponed. We’re all hoping you’re safe and sound. It was nice being safely snowed in up at our cottage celebrating with my family.

Our team had a few holiday events together, including a bit of a fancy party hosted by our brokerage at the Lambton Golf and Country Club - a chance to wear some sparkles!

Our JKTeam also celebrated the season with a delicious meal at Biff's Bistro - yummy French cuisine in downtown Toronto.

Our team also had a blast volunteering at Daily Bread - Thanks to our clients, they're rock stars! Susan Wood, Lynn Walks, Sam Mahgoub and Joanne McCourt. Emily shone with her fine dining skills:) Special thanks to Nelson and Jay too!

As you will see in my video in the next section about the Toronto Real Estate Market Watch, Mary and I enjoyed a holiday favourite - watching the world juniors men’s tournament that was held in the Maritimes. The games were exciting and a thrilling path to gold!

The market minute video gives you a bit of a summary of 2022. Realistically, how things are going to shake out in 2023 is anyone’s guess. Lots of people are forecasting and projecting - conveniently forgetting that a lot of the projections last year did not come true. I’m not going to pretend that I have a crystal ball. Bottom line is our team is here to help. If you have questions about the real estate market or if you, or any family and friends are making plans or have financial concerns and could use a helping hand, we will focus on your specific personal situation and give you some guidance.

We have a few more housekeeping items coming up for Toronto home owners:

The next scheduled date for the Bank of Canada to announce the overnight rate target is January 25, 2023. It is projected to be an up to .5% increase.

Reminder, as mentioned in the last Kinnear’s Komments newsletter the Vacant Home Tax is here - and the form must be filled in by Feb 2/23. Here is the link. It is very easy and straightforward. Be sure to fill it in for any real estate you own in the city, whether your primary residence or if it is being rented out.

Toronto homeowners could see a 7% increase in their property tax bill this year. Although Toronto property taxes are notoriously low, they are going up with inflation. - A 5.5% property tax hike and a 1.5% city building levy —has been part of the proposed operating budget released at City Hall. The budget must still be approved by city council, but strong mayor powers provided by the provincial government give Tory considerable clout to get it passed.

We are most grateful for the trust you have placed in us with referring your friends and family. Best wishes for 2023.

guiding you home™,

Julie

P.S. Please reach if you or someone you know is looking for trusted advice in the current market.

Quote of the Day:

Chit Chat...

Heidi Girvan founded HG Educational Consulting at a most important time. Heidi’s company provides a hands-on, bespoke concierge and advisory service that helps parents of children experiencing educational challenges navigate the system.

As an elementary teacher and mother of three kids, with decades of experience, Heidi understands how to connect you to the “best fit” educational resources and interventions for your child. Whether it be advocating for an Individualized Education Plan; understanding a Psychoeducational Assessment; or finding the best tutor, professional or private school, Heidi will coach and guide you through!

To contact Heidi Girvan: (416-258-3744)

www.hgeducationalconsulting.com

Krazy Kontest Winners…Kongratulations!

We are continuing the theme for prizes of a $75 GC to the restaurant of your choice and supporting local businesses!

December Winner was Mary Fisher! Mary chose a $75 GC to Capocaccia Trattoria restaurant in Rosedale!

The JKT - A few of our Favourite Things:

Holly

|

|

Jay

|

|

Julie

|

|

Brenda

|

|

Emily

|

|

Nelson

|

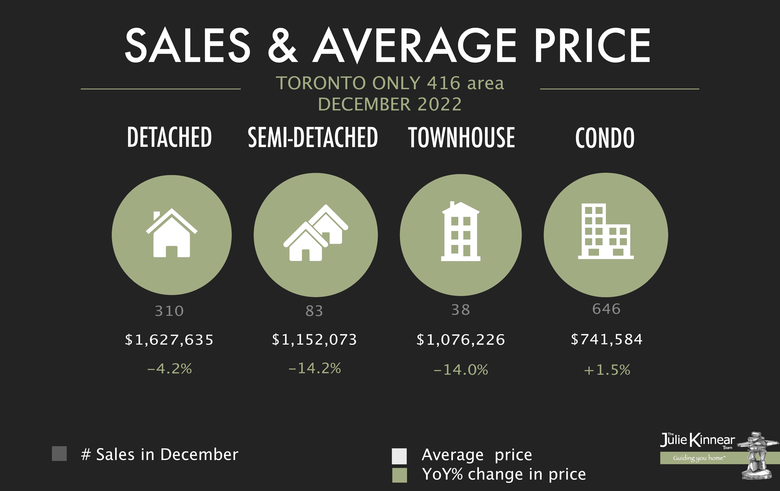

Market Watch ~ Market Adjustment - See Below for CITY OF TORONTO results.

Watch Julie's analysis:

Mortgage Rates

Variable Rate forecast - as variable rates are linked to a lenders'/banks' prime lending rate, any interest rate movement by the Bank of Canada (BoC) typically results in an immediate change to variable rates. A summary of the 2023 BoC meeting dates and our expectations are as follows:

● Jan 25, 2023 (anticipated: +0.00% or 0.50% increase)

● Mar 8, 2023 (anticipated: +0.00% or 0.25%)

● Apr 12, 2023 (anticipated: +0.00%)

● Jun 7, 2023 (anticipated: +0.00%)

● Jul 12, 2023 (anticipated: +0.00%)

● Sep 6, 2023 (anticipated: +0.00%)

● Oct 25, 2023 (anticipated: +0.00%)

● Dec 6, 2023 (anticipated: +0.00%)

As at the time of writing, the Big 6 Banks are generally forecasting the BoC to increase their overnight rate an additional 0.00% to 0.50% in January 2023, remain relatively flat during 2023, and then decline back to the 3.0% range by the end of 2024. For reference, the current Bank of Canada overnight rate is 4.25% with lenders'/banks' prime lending rate at 6.45%. On January 6th, 2023 it was released that the Canadian employment grew for the fourth straight month, adding 104,000 jobs in December. This is way higher than economists’ expectations which increases the likelihood of a 0.25% increase on January 25th, 2023. If they do increase the overnight rate by 0.25%, then we may see a 0.25% increase on March 8th. These expectations are based on economists’ forecasts. For more information from BNN Bloomberg click here.

Fixed Rate Forecast - 5-year fixed rates typically follow the Government of Canada's 5-year Bond Yields which is the market's view/prediction of where interest rates will be in the future.

5-year bond yields began their ascent in late 2021 and early 2022 in anticipation of the Bank of Canada rate increases that started in March 2022. Yields moved from the 1.5% range in January 2022 to a peak of 3.8% in October with 5-year fixed rates increasing accordingly. That being said, 5 year Canadian bond yields dropped on November 10th when US inflation figures came in below expectations (signaling that the economy is responding to Fed/Central bank rate hikes). Since then 5 year fixed rates have come down slightly. Bond yields are now in the 3.29% range, and if they hold, we could see lenders/banks continue to lower their 5 year fixed rates in the coming weeks.

Timely and Shareable News Articles:

● Surge in jobs suggests another rate hike awaits (Toronto Star)

● Canada labour market crushes forecasts, sending loonie higher

● Here's how investors can turn last year's mistakes into their future advantage(Financial Post)

● The question after a tough 2022: How much further do real estate prices have tofall?

For a customized analysis of which rate or product option might be right for you or your clients, please contact Sherry Mae Campodonico, Mortgage Agent of the Outline Team - (416) 434-2130,

Feeling like Giving Back?

Scarborough Feed. Such an innovative and cool organization. So dignified and respectful of their clients and users! So many incredible volunteers. Through the pandemic Scarborough Feed really stepped INTO the need and grew to serve more and more. 1 in 2 children in Scarborough are living in poverty.

Their vision: A Hunger free Resilient Scarborough. At Feed Scarborough they empower the community and provide innovative solutions to poverty reduction, through dignified access to food. They advocate for and believe that good healthy food is a human right.

Some of the incredible highlights: Be sure to check out their website here.

● Feed Scarborough Food Banks serves ANYONE who needs some help. Their food banks are as accessible and barrier free as possible. They built online food banks through Covid, so food could be safely picked up, in addition to their Mobile Healthy Meal Programme.

● Feed Scarborough have multiple locations for convenience and to ensure everyone in the East has access nearby. They recently adapted their FREE “Grocery Store" model in all their food banks, where clients can choose what they want, and shop themselves.

● Feed Scarborough have a Canteen where clients can drop in for a healthy food program. Ensuring their belief that a “Fresh Healthy Food is a Human Right, and everyone deserves two meals a day.”

● Feed Scarborough Training Centre was created as a Hospitality, Culinary &

Customer Service Training Centre for Youth, New Canadians, Refugees or anyone looking for a second career.

● Feed Scarborough also has Community Gardens - Plump tomatoes, spicy peppers, sweet strawberries... Feed Scarborough grow food right in Scarborough.

● Feed Scarborough also host an annual Summit on Poverty, Inequity & Hunger.

If you are in the position to pay it forward, please donate to one of these worthy charities during this time. 💕

The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

A company's success is strongly impacted by the customer reviews and for those of us in real estate, Google reviews and Facebook reviews create the biggest impact. We are asking for your help to go online and add your input and we will happily donate to a charity of your choice for your efforts!

You can do it on Google Maps here (it's very very important that you write a comment as well in addition to the rating), or you can also leave the same review on JKT's Facebook page here by clicking on "Yes" next to the "Do you recommend the JKT?" It's true, 5* reviews are almost as precious as a referral nowadays!

Interested in new build condos and townhouses? We have access to pre-public sales of new developments. Be sure to get in touch to take advantage of this leg up!

What They Got - More of our happy buyers & sellers!

A continuing column of the Julie Kinnear Team's sales...

|

|

|

|

45 Havelock St - Dufferin Grove - represented seller |

1504 - 100 Quebec Ave - High Park - represented buyer |

|

|

|

|

70 Fermanagh Ave - Roncy - represented seller |

|

Did You Know? We have a large number of awesome trusted realtors in different towns and communities across Ontario, Canada and Internationally. Just get in touch so we can introduce you.

Our Purpose

Our purpose is for you to be so outrageously happy with the service we provide that you gladly refer us to your friends and family before you've even bought or sold with us.