Vol. 30, Issue 2, October 2022

- Julie's Scoop

- Quote of the Day

- This Month’s Featured Property

- Krazy Kontests

- Real Estate Market

- Mortgage Rates

- Feeling like Giving Back?

- The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

- What They Got - More of our happy buyers & sellers!

- A few of our Favourite things

- Special bonus - Current mortgage rates - How does that affects you

Julie's Scoop

Greetings!

Hope you had a Happy Thanksgiving! What a magical time of year. The leaves are just gorgeous changing in the city and certainly anywhere north. I am currently looking forward to Halloween as well, as my brother Alec and his partner Lucia are arriving from Kittsee, Austria in time for trick or treating. It has been a long time since Brenda & I last visited in Nov 2019, and the youngest Aurelién was not even born yet.

Julie visited the Bloklands in their new home in Guelph, after selling in Bloor West Village

The JKT have been enjoying our weekly team meetings outdoors in the glorious summer and fall weather - often you can find us hanging out at The Good Neighbour on Annette in the Junction, or in my own back yard.

Fun outdoor team meetings this summer!

Mary & I had a lovely summer welcoming more friends and family to the cottage with the covid restrictions lifting, and playing with our new boat. Ontario in all seasons is glorious.

Jen & Elena Palacios - enjoying the new boat with Jules

We’re all hands on deck in this “new” real estate market. What a change from earlier this year! Funny how no one has a crystal ball on when or how much it goes up or down - way too much media hype either way. Be sure to stick to your OWN life plans and dreams and not watch from the sidelines! This current market means awesome opportunities for different segments of the population now! TRREB stats are in, please check out the video I put together to capture the some of my own opinions & thoughts about what is REALLY going on in the streets… you’ll also hear how the last time there was a dip in the market those who walked fearlessly through it, and didn’t “follow the crowd” fared much better than “waiting for the perfect time”.

guiding you home™,

Julie

P.S. The most important thing to do if you are contemplating your options is to stay up to date and informed. Toronto is full of micro markets, and things are constantly changing.

We are here to help guide you or any of your friends and family to understand your specific needs to reach your housing or real estate investment goals. Thank you for your trust.

Quote of the Day:

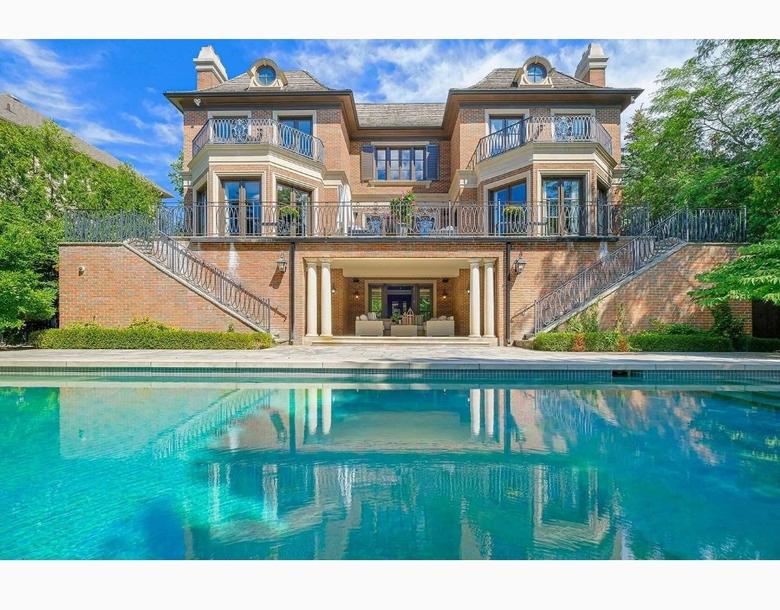

This Month’s Featured Property

45 Havelock Street | Central Toronto - Dufferin Grove $1,998,000

Ideal for a growing family, work from home or live in/rent out in two gorgeous suites for bonus income. Are you looking for character & space & low maintenance mechanicals in a hip central ‘hood? Do you have a green thumb and would love the huge organic garden? Are you looking for a property that you could build a Garden Suite/Laneway Home? This one qualifies for largest Garden Suite - potential income, work space with room for garage parking!

This beauty has been extensively upgraded & features amazing open concept main and second floors. There is a fabulous above grade family room, main floor addition, and dug out professionally finished basement with separate entrance. It’s one of those wonderful HUGE semis - 3300 sf incl. lower level. Set on a rare 25x147 foot lot = fab backyard & parking

Krazy Kontest Winners…Kongratulations!

Krazy Kontest Winners… Love supporting LOCAL! We are continuing the theme with all winners getting to choose their favourite neighbourhood restaurant for the JKT gift certificate. BTW you can enter this month's Krazy Kontest HERE.

One of our winners of the grand prize Krazy Kontest - and they are at Cool Hand of a Girl in the Junction.

Kongratulations to our September KK winner Phil Smith - Chose his $75 Gift card for The Ace Restaurant (Roncy - Roncesvalles Ave/Fermanagh Ave)

Kongratulations to our August KK winner Dustin Pierce- Chose his $75 Gift card for Venga Cucina (Junction - Dundas St W/Quebec Ave)

Kongratulations to our July KK winner Donna Seto - Chose her $75 Gift card for Azaria’s Restaurant (The Kingsway - Bloor St W/Brentwood Rd N)

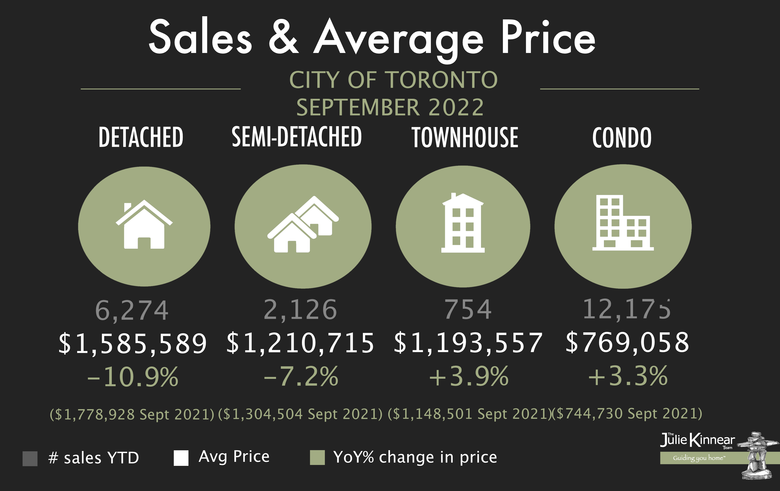

Market Watch ~ September #’s are in from TRREB - See Below for CITY OF TORONTO results.

Watch Julie's analysis:

Market Moment October 2022

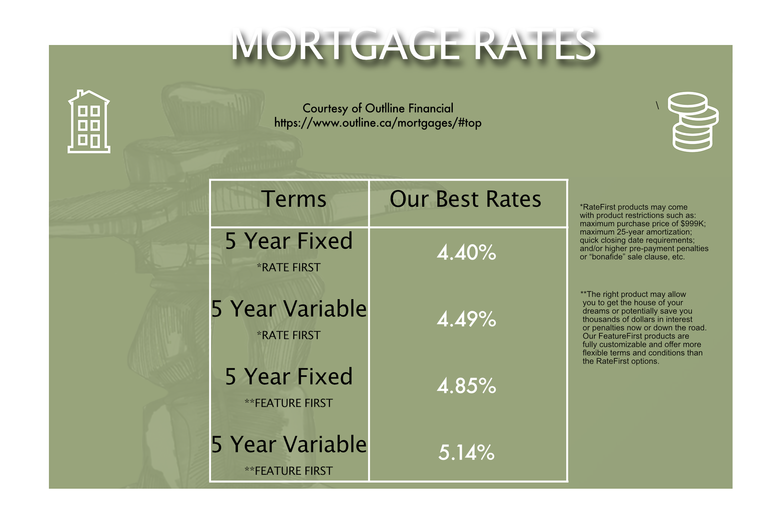

Mortgage Rates

Feeling like Giving Back?

Feeling like Giving Back? 3 INSPIRING CAUSES to Donate to! Throughout the Pandemic, our team has doubled down on giving back to local charities that benefit from the $$ and exposure.

Second Harvest: Food insecurity has only been exacerbated during the pandemic. In 2021 there was a 47% increase compared to the previous year and is 1.5 times higher than the previous record set in 2010 at the peak of the 2008 recession.

Second Harvest focuses on rescuing food to make positive social and environmental change. Second Harvest is Canada’s largest food rescue organization and is a global thought leader on perishable food redistribution. They work with thousands of food businesses from across the supply chain utilizing logistics and technology to reduce the amount of edible food going to waste, thereby diverting unnecessary greenhouse gasses from entering the environment.

Second Harvest inclusive model ensures this healthy surplus food is redirected to a network of social service agencies across Canada including food banks, meal programs, children’s breakfast programs, community centres, drop-in centres, summer camps, women’s shelters, homeless shelters and centres for addiction and mental health treatment, providing access to the nourishment they need.

416.408.2594 or

Sunnybrook’s Family Navigation project helps youth struggling with mental health and addiction get the specialized care they need.

The Family Navigation Project is 100% funded by donations from the community.

The project is unique and designed to assist families negotiate their journey through an often complex health care system. The project ensures that patients can focus on what is most important: healing. Its existence is due to the perseverance of a group of parents who were determined to help youth and make sure that other families who were facing the same situation didn’t get “lost” and received personal individualized support along the way.

1-800-380-9367 or

In honour of the National Day for Truth and Reconciliation on September 30th, we chose to donate to Anishnawbe Health Foundation which is an Indigenous-led registered charity. This contribution is to their fundraising for Anishnawbe Health Toronto’s new health care centre being built in the West Don Lands, and to support programs at the new Centre.

Anishnawbe Health Toronto’s model of health care is based on Indigenous culture and traditions and as a result, AHT is the only facility in Toronto that cares for Indigenous clients with both western and traditional approaches to health care. This includes Primary Health Care including an ambulatory health centre, Diabetes Education and Prevention Programs, Health Promotion and Physiotherapy. Mental Health & Addiction Programs, Child, Youth and Family Care including Pre and Post Natal Care Programs, Youth Outreach.

416-360-0486 or

If you’re in the position to pay it forward, please donate to one of these worthy charities during this time. 💕

The Julie Kinnear Team's GEMs (Genuine Evidence of Merit)

A company's success is strongly impacted by the customer reviews and for those of us in real estate, Google reviews and Facebook reviews create the biggest impact. We are asking for your help to go online and add your input and we will happily donate to a charity of your choice for your efforts!

You can do it on Google Maps here (it's very very important that you write a comment as well in addition to the rating), or you can also leave the same review on JKT's Facebook page here by clicking on "Yes" next to the "Do you recommend the JKT?" It's true, 5* reviews are almost as precious as a referral nowadays!

Interested in new build condos and townhouses? We have access to pre-public sales of new developments. Be sure to get in touch to take advantage of this leg up!

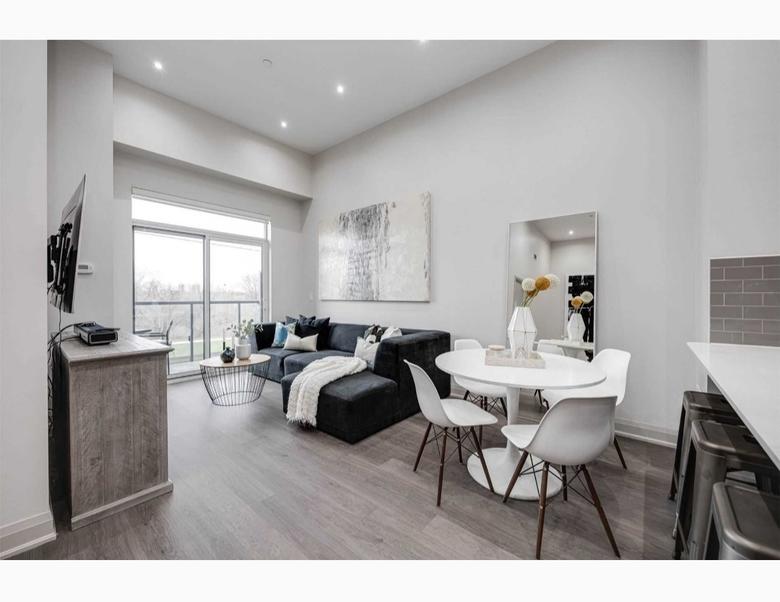

What They Got - More of our happy buyers & sellers!

A continuing column of the Julie Kinnear Team's sales...

Did You Know? We have a large number of awesome trusted realtors in different towns and communities across Ontario, Canada and Internationally. Just get in touch so we can introduce you.

Our Purpose

Our purpose is for you to be so outrageously happy with the service we provide that you gladly refer us to your friends and family before you've even bought or sold with us.

The JKT - A few of our Favourite Things:

Special Bonus Section - How can current mortgage rates affect you

Outline Financial have put together a great question & answer for those wondering about the effect of the rising mortgage rates.

___________________

Bank of Canada Increased Overnight Rate by 0.75% (75 basis points): Why and How it could impact you.

In September, with inflation still running stubbornly hot, as of September 2022, the Bank of Canada raised the Overnight Rate by .75%. BofC have not shut the door on further increases. Most banks/economists believe we are approaching a plateau, but acknowledge that we could see an additional 0.25% to 0.75% of total increases in late 2022 or early 2023 before we get to that point. Next announcement is October 26/22.

Why did the Bank of Canada (BofC) increase their overnight rate by 0.75% in September?

In its accompanying press release the BofC provided context for its increase by stating: “...The global and Canadian economies are evolving broadly in line with the Bank's July projection. The effects of COVID-19 outbreaks, ongoing supply disruptions, and the war in Ukraine continue to dampen growth and boost prices..."

"...The Bank's core measures of inflation continued to move up, ranging from 5% to 5.5% in July. Surveys suggest that short-term inflation expectations remain high. The longer this continues, the greater the risk that elevated inflation becomes entrenched. The Canadian economy continues to operate in excess demand and labour markets remain tight...With higher mortgage rates, the housing market is pulling back as anticipated..."

"...Given the outlook for inflation, the Governing Council still judges that the policy interest rate will need to rise further...As the effects of tighter monetary policy work through the economy, we will be assessing how much higher interest rates need to go to return inflation to target."

What could this mean for you?

While the Outline Financial team is on standby to discuss how these changes may impact your specific circumstances, we have included a few scenarios below that cover our most frequently asked questions from existing mortgage holders as well as those looking to secure a mortgage.

Scenario 1: I currently have a variable “non-adjustable” mortgage (VRM), how will this impact me?

- In this scenario your mortgage payment will remain the same, however, a higher proportion of each payment will go towards paying interest vs. principal. The net impact is an extended amortization (total amount of time to pay off your mortgage will be longer).

- What can you do? As the variable rate remains below fixed rates, you could keep everything the same and continue with the same monthly payment. Alternatively, you could increase your mortgage payment to ensure you remain on pace with your current amortization schedule.

- Be aware of your Trigger Rate. As interest rates rise, there may be a point where your set VRM payment can no longer cover the interest calculated (and charged) on the outstanding mortgage amount. This is known as the Trigger Rate. In this scenario your mortgage may have an increasing balance unless the payment is increased enough to cover the outstanding interest.

- For questions on your payment strategy, trigger rate, trigger point, or to review potential pros/cons of converting your current VRM into a fixed mortgage, please reach out at any time.

Scenario 2: I currently have a variable “adjustable” mortgage (ARM), how will this impact me?

- In this scenario, your mortgage payment will automatically increase to ensure you keep pace with your current amortization schedule. If you would like to discuss future interest rate projections, or the potential pros/cons of converting your ARM into a fixed mortgage, please reach out at any time.

Scenario 3: I currently have a fixed-rate mortgage, does the recent change impact me?

- If you have a fixed-rate mortgage, there is no impact on your mortgage payment (or amortization) as you have received a guaranteed rate for the duration of your mortgage term. Only when your mortgage comes up for renewal, or if you sold and purchased a new home, would you potentially be impacted by higher rates.

Scenario 4: I am currently looking to secure a new mortgage, a pre-approval, or refinance an existing mortgage.

- Fixed or Variable? While each circumstance is unique, there are a couple of key points that you will want to keep in mind if trying to decide between the two.

- Variable rate mortgages are directly impacted by the Bank of Canada as described in Scenario 1 and 2 above and your interest costs will move up or down based on the BofC rate decisions making them more volatile. However, variable rate mortgages are generally more flexible than fixed rate mortgages in terms of penalties if you ever need to break your mortgage.

- 5-year fixed mortgage rates typically follow the Government of Canada 5-year Bond Yields which is the market’s view/prediction of where interest rates will be in the future. The 5-year bond yields actually started moving upward back in early 2021 in anticipation of the Bank of Canada rate increase(s) we are now seeing in 2022. Bond yields (and fixed rates) have risen to levels not seen since 2008.

- 2, 3, and 4 year fixed mortgages. As many economists believe our rapidly growing economy could turn recessionary in the next few years (resulting in lower interest rates), many clients are opting for shorter term fixed rates given the benefit of lower rates vs. the 5-year fixed, a fixed payment vs. the ARM, and a guaranteed interest rate vs. the VRM.

- Mind the Gap – when deciding between fixed and variable it is important to analyze not only the difference in the current rates, but also the expectation of future Bank of Canada rate changes. For example, if the current fixed rate (a sure thing over the term of your mortgage) is 1.00% higher than the current variable rate option (subject to change over the term of your mortgage), will that initial 1.00% “GAP” or “initial rate savings” be sufficient to protect you from any future Bank of Canada rate increases? Every situation is unique and we have a number of tools that can help model out the expectations for your specific circumstances.

Important Reminder: Stress Test & Variable Rate Pre-Approvals

- Stress Test Reminder: To help ensure clients can absorb interest rate shocks, all banks and federally regulated lenders are required to qualify clients' based on a "Stress Test" interest rate set at the greater of 5.25% or the clients' actual mortgage rate +2.00%.

- Use of Credit Unions are increasing as they do not fall under the same regulations and so avoid the stress test. Often their rates are marginally higher, but a good option for some.

- Why does this matter? After the recent Bank of Canada increase, the stress test rate has increased for variable rate mortgages which will reduce a clients' borrowing/purchasing power (rule of thumb: each 1% increase in the stress test rate is equivalent to an approx. 8% reduction in borrowing/purchasing power). If you have an existing variable rate pre-approval, or would like to secure a pre-approval, please contact a member of the Outline Financial team so we can help quantify the impact of this change.