We are all in this together!

We have composed for you as much info as we can to help you navigate the various options that are out there and alleviate some of the financial stress that so many of us are facing. We will update this regularly with more up-to-date information as it comes available.

https://www.insurancebusinessmag.com

Ontario's Emergency declaration

In an effort to stop the spread of COVID-19 and keep people home Ontario’s Emergency Declaration has been extended until April 14, 2020 in order to stop the spread of COVID-19. It includes the closure of non-essential workplaces and restrictions on social gatherings and in addition closure of all outdoor recreational amenities, such as sports fields and playgrounds, effective immediately.

Taxes

Toronto Property tax deadline has been extended from April 1st to June 1st. It is still recommend filing in paperwork as you might have more time on your hands and many full-time employed individuals will receive refunds. On the other hand if you do owe, tax payments can be deferred until August 31st.

www.chartercitytoronto.ca

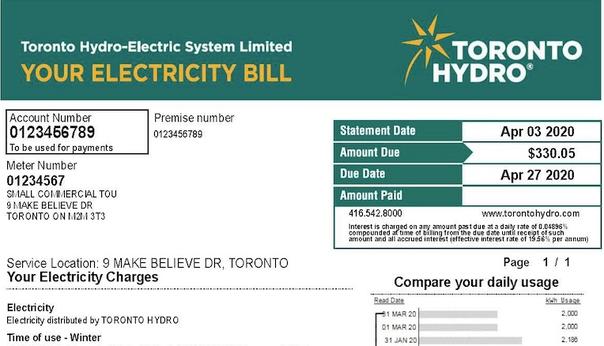

Energy Bills

Ontario hydro rates will temporarily suspend time-of-use pricing, charging off-peak hours 24/7 for the next 45 days. It is expected to save the average household around $20 per month.

Toronto sewer, water and solid waste bill deadlines have been extended by 60 days.

Official paperwork and other bureaucracy

Ontario has extended the driver’s license and Ontario Health Insurance cards (OHIP) to an undetermined date at this time.

Employment insurance

People that have lost their job and qualify for Employment insurance (EI), you can receive benefits faster, up to 55% of your pre-tax income for up to 35 weeks for employees receiving benefits or 13 weeks.

www.canada.ca

If you have paid into EI, lost your job through no fault of your own and have worked enough insurable hours, you are eligible to file for EI benefits. You need between 420 and 700 hours of insurable employment, depending on the unemployment rate in your region. The basic rate for most people is 55 per cent of their average insurable weekly earnings, up to a maximum of $573 a week, or about $2,292 a month. Duration of help ranges from 14 weeks to a maximum of 45 weeks. You can apply for EI in here (also includes list of documents necessary). Money should reach you within 28 days of applying with all the necessary documents but as the government indicated the process will speed up.

Freelance workers may also qualify for EI benefits as well (update on that is coming soon)

Other benefits

The Canadian government is proposing a one-time special GST credit as soon as May. For those with low or modest incomes, this amount is expected to be around $400 for an individual or $600 for a couple.

Sick leave benefits are expected in April for those who don’t receive anything through their employer. The pay is up to $900 every 2 weeks for up to 15 weeks.

Parents staying home to care for their kids who aren’t in school may be eligible to receive a one-time increase of $300 per child as part of the Canada Child Benefit.

To support workers who lost their job due to the COVID-19 pandemic, the federal government has introduced legislation to establish the Canada Emergency Response Benefit (CERB) which combines the previously announced Emergency Care Benefit and Emergency Support Benefit into one simpler and more accessible program. CERB is a taxable benefit that will provide $2,000/ month for up to 4 months for workers who lose their income as a result of the COVID-19 pandemic. It also covers Canadians who have lost their job, are sick, quarantined or taking care of someone who is sick with COVID-19 and it applies to working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures. The CERB is going to be available to employees, contract workers and self-employed individuals who would otherwise not be eligible for EI. For example realtors would qualify for this program. The official portal for registering for CERB will be available in early April. For more details on the CERB, please click here.

Should you need to take money out of your registered savings plan, the annual minimum withdrawals from Registered Retirement Income Funds (RRIFs) have been reduced by 25%.

Mortgages

Mortgage deferral on a primary residence is available through most banks for 6 months. Some banks will offer this option also for rental investment properties. Do not forget deferral will not cancel your interest charges accumulating during this time.

Helping businesses

Wage subsidy will be raised from 10 percent to 75 percent, and will be backdated to March 15. Businesses and non-profit organizations seeing a drop of at least 30 percent in revenue due to COVID-19 will be able to qualify for the government’s 75 percent wage subsidy program. The government is hoping employers will be able to keep workers on payroll or rehire those that have been laid off. All impacted businesses, big and small, will qualify. The government will cover up to 75 percent of a salary on the first $58,700 which could mean payments of up to $847 a week for each employee. Businesses are encouraged to top up their employees’ wages with the remaining 25 percent of the salaries. The program will operate on a good faith as checking paperwork in detail would significantly defer release of this help. But companies who decide to abuse this program will face serious consequences.

The government is also launching a new loan program – Canada Emergency Business Account (CEBA). Banks will be able to offer $40,000 loans, guaranteed by the government and interest-free for the first year, to qualifying businesses. Repaying the balance of the loan on or before December 31, 2022 will result in loan forgiveness of 25% (up to $10,000). In addition, the government will be providing $12.5 billion to Export Development Canada and the Business Development Bank, to help small- and medium-sized businesses with their cash flow requirements when applying for loans.

GST and HST Payments Deferrals plus duty and taxes on imports will be in place until June 2020. This will leave companies to pay for immediate expenses.

Education

For now public schools will remain closed to teachers until Friday, May 1, 2020 , and to students until Monday, May 4, 2020. As these dates come closer, this decision will be re-evaluated based on public health advice. The closure may be extended if necessary.

Select emergency child-care centres are now open for health care and frontline workers to send their children to while they are at work. Find out if you are eligible to send your child to emergency child care here.

Payments for Ontario Student Assistance Program (OSAP) loans are now officially temporarily deferred. Online supports are to be provided for students, including online year-end exams. In addition, funds are to be made available to colleges and universities to help them deal with the impact of COVID19.

There are still unanswered questions about final grades especially Grade 12 students need answers about how their final grade will be determined and what impact that will have on their post-secondary plans. But as government announced no student will have their graduation compromised by COVID-19 and the Ministry of Education will work together with the Ministry of Colleges and Universities to ensure that there will be no barriers to accessing post-secondary education.

There is a solution coming to ensuring access to internet-connected devices especially in families facing economic challenges in many rural or northern territories. Also help to parents that need extra support to get special needs students through the next few weeks at home.

In the second phase of Learn At Home, the province is working together with the education community on a number of fronts including teacher-led learning by grade groupings as follows:

* Kindergarten to Grade 3: five hours of work per student/week (focus on literacy and math)

* Grades 4 to 6: five hours of work per student/week (focus on literacy, math, science, social studies)

* Grades 7 to 8: 10 hours of work per student/week (focus on math, literacy, science, social studies)

* Grades 9 to 12: three hours of work per course per week for semestered students; 1.5 hours of work per course per week for non-semestered students (focus on achieving credits/completion/ graduation).

You can also get up to date information on the following links:

Canada’s COVID-19 Economic Response Plan: Support for Canadians and Businesses

Toronto.ca: Economic Support & Recovery for Individuals & Families

Economic Support & Recovery for Businesses

Official and reliable information on Coronavirus disease (COVID-19):