The Financial Post informed in December that Toronto housing prices are to double over the next 25 years, according to a forecast by Central 1 Credit Union. Apparently, home sales in Ontario should be hindered by increasing mortgage rates in the next three years but the market is unlikely to experience a correction. Helmut Pastrick, chief economist of Central 1 Credit Union, predicts Ontario home prices to grow a modest 4 to 5 per cent through 2016 and double over the next 25 years. Such expectations might seem like a big deal but all in all the rate of return is not that great.

Condos In Toronto Harbor By James Wheeler

A doubling in prices over 25 years represents a 2.81 per cent compound annual growth rate (CAGR) over this period which turns out to be 4 per cent yearly after compounding is taken into account. Such increase is not surprising and many experts point out that such projection is quite conservative. As Jeffrey Joseph, a Toronto-based Realtor, told us,

If present trends continue, it may not take that long for the average price to double in Toronto. Immigration and the birth rate will have a lot to do with it. Properties doubling in ten years is not unusual, and I have seen some double in about five years.

Moreover, it should be pointed out that this forecast does not take into account all the costs homeowners have to pay, including the property taxes, utilities, insurance, repairs and maintenance, condo fees, land transfer taxes or H.S.T. An increase in the price of these factors could eat a significant portion of the return on investment and in case their growth exceeds 4 per cent, it would cause home owners to actually lose money.

For a better picture, we can have a look at the statistics from the period between 1980, the first year that Canadian Real Estate Association started to consistently publish average residential home prices, and 2012. TD Economics informed in their report from March 2013 that during this period Canadian residential home prices went up by an average 5.4 per cent per year while headline inflation in Canada averaged 3.3 per cent per year. Taking into account inflation, the annual real rate of return from real estate investment was 2.1 per cent during this period. The rate of return on investment would be even lower if we add the increase in home owners’ expenses on taxes, utilities, insurance, repairs and maintenance, etc. However, the expectations of Central 1 Credit Union imply an even poorer rate of return in the future.

Residential Houses In Toronto By Dylan Passmore

In the next 25 years, a 4 per cent increase (2.81 per cent CAGR) in the price of your house will not only be wiped out, but it is very likely that it will even cost you 1 per cent a year out of your own pocket from the escalating property taxes, utilities, repairs and maintenance, insurance, upfront H.S.T., lawyers fees, land transfer taxes, etc. This issue raises a question whether it’s smart to invest into residential property in such market conditions. Owen Price, a Realtor from London, Ontario, remarked,

Your personal residence should not be considered an investment. When it’s cheaper to own, you should own. If it’s cheaper to rent, then you should rent. The issue is that people often compare how they would like to live with what they currently live in. At the present time, as it has been for many years now, it has been less expensive to own if you’re comparing similar property types and location. This also allows you to build equity.

Furthermore, if we take into consideration that you actually rent out a place, you might consider yourself lucky to make 2.5 to 3 per cent a year net provided you won’t have any problems with tenants for 25 years such as non payment of rent or property damage. In addition, your house will always have to be rented 12 months a year without a period of vacancy. Even the biggest optimists would think that such scenario is highly unlikely. You also have to take into account that all the net rent you make is fully 100 per cent taxable and a principal residence is only capital gains tax free when sold and never, never rented. Jeffrey Joseph further commented,

Income from renting property is taxable less the operating expenses. Depreciation of the building may be deducted as an expense, but not the land. However, recapture of that depreciation will be added to your income in the year in which the property was sold unless, the building was torn down prior to the sale. This recapture of depreciation will incur a huge amount of tax obligation, so don’t take depreciation unless you plan on taking the building down before closing a sale.

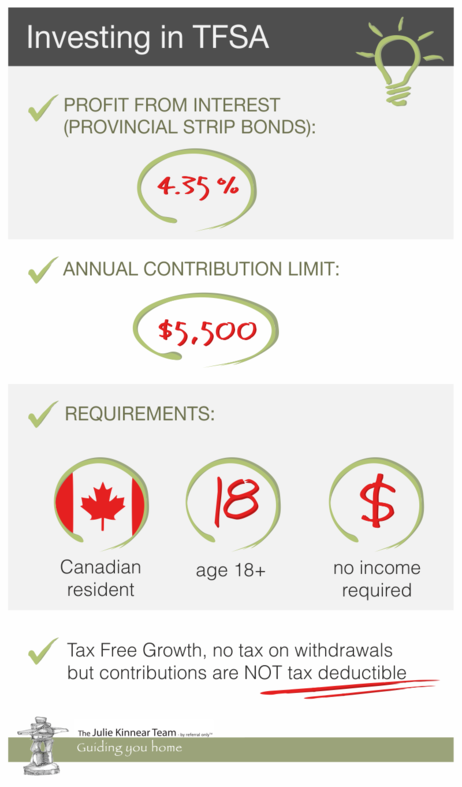

When purchasing real estate property, many people chose to finance it using tax-free savings account (TFSA). However, this investment option can be used even if you’re not buying a home or when your house is paid off completely. You can contribute up to $5,500 a year to your TFSA if you are a Canadian resident older than 18 years. It is a flexible saving vehicle which provides tax benefits for lifetime savings. Investment income such as capital gains and dividends, earned in a TFSA is not taxed, not even when withdrawn. However, contributions are not tax-deductible. TFSA’s for the whole period from 2009 to 2013 for those who never contributed are $25,500 per adult person.

Woodbine Beach Houses In Toronto By Grant MacDonald

With Provincial strip bonds, TFSA’s are yielding as high as net 4.35 per cent. In 25 years, this is a 290 per cent increase or 2.9 times the amount invested. It is all income tax free plus if you’re not purchasing real estate property, you don’t have to worry paying all the property taxes, insurance, repairs and maintenance, utilities, H. S. T., lawyer fees, land transfer taxes, etc. Every year with big increases.

Another important factor to consider when investing into real estate property is financing with a mortgage. Even though the government shortened the maximum amortization period for a government-insured mortgage to 25 years in summer 2012, many people have 30 and 35 year amortization mortgages with a down payment of 20 per cent or more. If you’re planning to pay off your house in the next 25 or more years, you have to consider rising mortgage interest costs and CMHC insurance if your down payment is less than 20 per cent of equity. This makes the situation of home owners even worse if prices in the next 25 years are to double, as the Central 1 Credit Union study expects.

As Jeffrey Joseph told us, the good thing about investing into a house is that you have a place to live in, and “it isn't just about the investment aspect or money.“ The market conditions are tight, markets are historically overvalued, net rental income is fully taxable and home ownership expenses are growing. In addition, banks consider rental property risky and they may not lend as much as they would for a property that you are planning to live in. Buying property as an investment in these conditions is risky and you should think through your situation as well as the situation on the market. Nevertheless, Owen Price suggested,

Real estate has made more people wealthy than any other business venture. Not everyone has the stomach for it though. It generates income so you should expect to work for it.

While the return on investment from renting a property in nowadays market can be negative, investing into your main property has an added value. It is a place where you live which is much more than a mere investment and most homeowners treat their homes accordingly. Investing into your personal residence allows you to built significant long-term equity plus principal residence is only capital gains tax free when sold and never rented.

VS00SK